Seoul: Global dynamic random access memory (DRAM) shipments dropped nearly 6 per cent in the fourth quarter from three months earlier, a report showed on Friday, amid sluggish demand from manufacturers that had hoarded up the key consumer electronics component over continued chip shortages.

DRAM shipments during the October-December period were valued at $25 billion, down 5.8 per cent globally from the previous quarter, according to the data provided by industry tracker TrendForce. Declining purchasing momentum, it said, also led to a drop in DRAM prices.

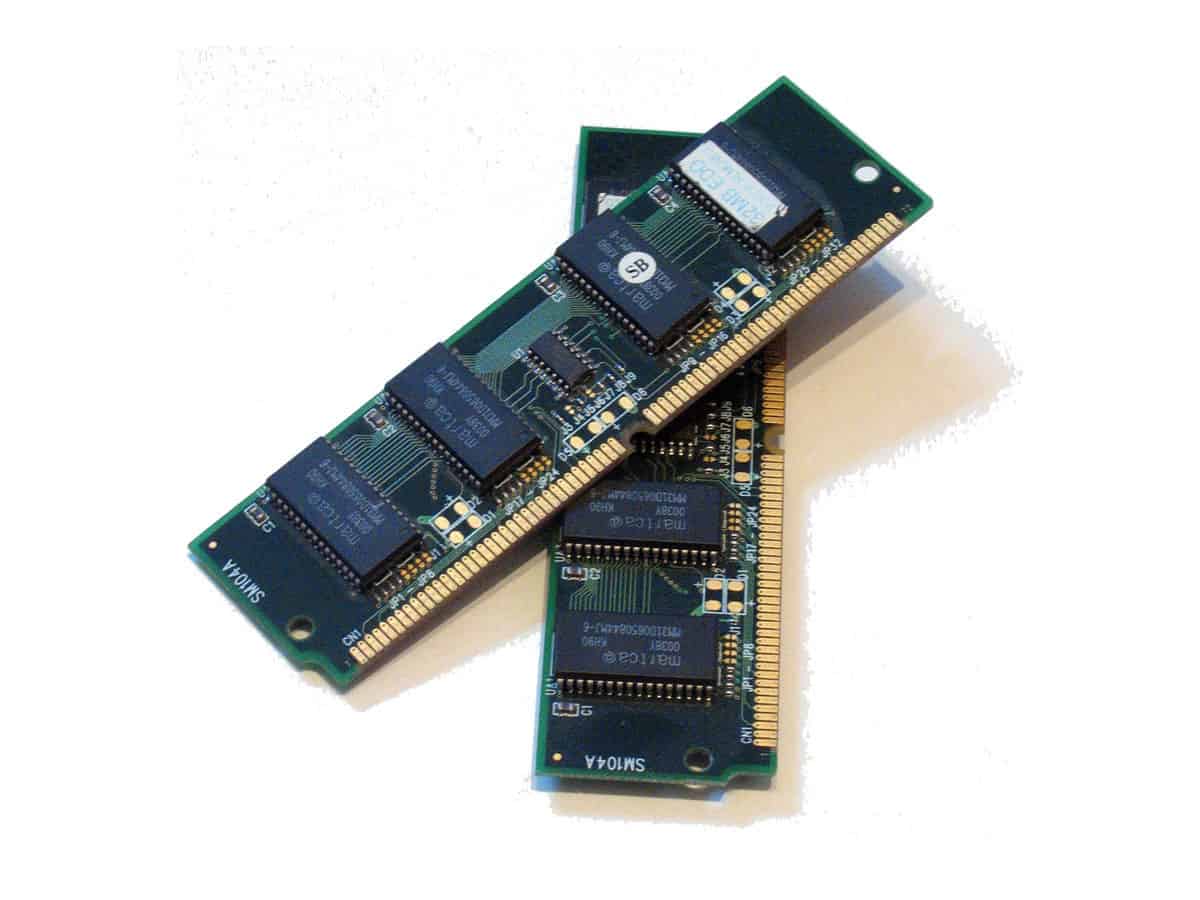

DRAM is a type of volatile semiconductor memory that retains data as long as power is supplied. It is commonly used in personal computers, work stations and servers.

The report expected the trend to continue into the first quarter of 2022 on sluggish demand and abundant inventory, further putting downward pressure on DRAM prices.

DRAM revenue at Samsung Electronics Co., the world’s largest memory chipmaker, dropped to $10.5 billion in the fourth quarter, down 9 per cent from the third quarter, according to the report.

In its fourth-quarter earnings report in January, Samsung said, “Overall demand in the memory business, centered on server, was solid but earnings declined quarter-on-quarter due to a continuation of global supply chain issues and a slight drop in average selling price.”

For the first quarter, it said it will “focus on maximising the quality of the business portfolio through higher sales of advanced node products to support the server and PC demand recovery.”

However, Samsung warned that, “lingering uncertainties are likely to persist”, referring to risks associated with the spread of Omicron and global supply chain issues.

SK hynix, the world’s second-largest memory chipmaker, saw its DRAM revenue rise 2.8 per cent to $7.4 billion in the fourth quarter, bucking the industry trend, according to TrendForce.

Announcing its fourth-quarter earnings results, the company attributed the revenue growth to its focus on flexible supply management, among other things, reports Yonhap news agency.

“SK hynix decided to continue its strategy of focusing on profitability while containing market volatility by managing its DRAM inventory flexibly,” it said.

Meanwhile, Samsung’s DRAM market share slightly dropped on-quarter to 42.3 from 44 per cent, while SK hynix climbed 2.5 percentage points to 29.7 per cent. The US chipmaker Micron Technology Inc. ranked third at 22.3 per cent.