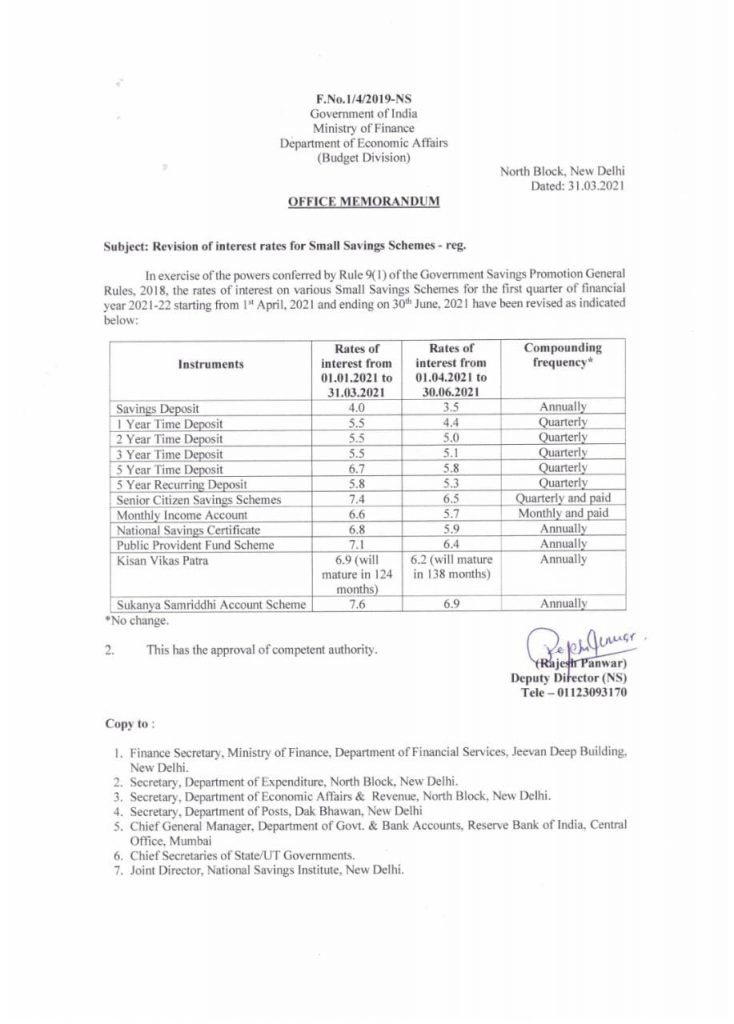

New Delhi: In a jolt to savers, the Finance Ministry on Wednesday had reduced interest rate by up to 1.1 per cent across various small savings schemes, including the National Savings Certificates (NSC) and Public Provident Fund (PPF).

In an order released late Wednesday evening, the ministry of finance revealed that interest rate on Public Provident Fund (PPF) has been reduced by 0.7 per cent to 6.4 per cent while National Savings Certificate (NSC) will now earn 0.9 per cent less at 5.9 per cent.

The notification also reduced the interest rate for the five-year Senior Citizens Savings Scheme steeply by 0.9 per cent to 6.5 per cent. The interest on the senior citizens’ scheme is paid quarterly.

However, hours after issuing orders, Nirmala Sitharaman on Thursday withdraws them by saying that the government will restore the rates to the last quarter of the financial year ending on March 31.

“Interest rates of small savings schemes of GoI shall continue to be at the rates which existed in the last quarter of 2020-2021, ie, rates that prevailed as of March 2021. Orders issued by oversight shall be withdrawn,” Sitharaman said in a early morning tweet.

The new interest rate on PPF would have been the lowest since 1974. According to reports, the PPF interest rate was 7 per cent between August 1974 and March 1975. Prior to that, the rate was 5.8 per cent.

Last month, the Reserve Bank of India (RBI) kept interest rates static for the fourth time in a row at 4 per cent on inflationary concerns.

(With agency inputs)