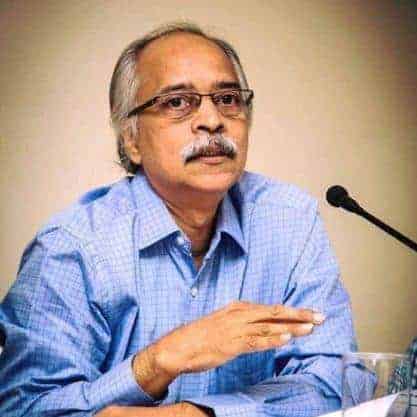

In the royal meeting hall of Bella Vista in Hyderabad, one familiar personality, who strode the dais with his prominent presence and erudition for over two decades (1993-2015) was Mr M Narasimham, the former Governor of the Reserve Bank of India (RBI).

Though short statured his baritone voice and crisp but insightful observations at many important policy meetings, training courses for MPs, IAS, brainstorming sessions etc., as Principal and later as Chairman of the Board of the Administrative Staff College of India (ASCI), surely have left a deep imprint.

In the passing away of Mr Narasimham at the ripe age of 93, due to COVID-19 related complications in Hyderabad on Tuesday, the world of Indian banking has lost a giant and the country, a dedicated scholar. He was the first RBI governor from the ranks, having joined the apex bank as a Research Officer in the Department of Research and Statistics.

A grandson of Dr Sarvepalli Radhakrishnan, President of India, Narasimham served as the 13th Governor of the RBI, for a short period of just over seven months in 1977. He was succeeded by Dr IG Patel. Before that, he was Secretary, Banking and Additional Secretary, Department of Economic Affairs. He rose to represent India as the Executive Director at the IMF.

Architect of Banking Reforms

Mr Narasimham is often referred to as the ‘Father of Indian banking reforms’. His momentous contributions came during his tenure as the Chairperson of the Committee on the Financial System in 1991, when India was passing through a serious economic crisis. Then came his substantial role in shaping the banking sector reforms as the Chairman of the Committee of Banking Sector Reforms, 1998.

Among the many contributions, a couple of the most pronounced outcomes of his role in the banking sector are the setting up of the Regional Rural Banks (RRBs), the Industrial Development Bank of India (IDBI) and the National Credit Councils. He also served as the Vice President of the Asian Development Bank (ADB), Manila.

The Narasimham Committee report made many recommendations including the creation of new generation private sector banks. Post 2000, we have seen the creation and growth of private sector banks like the ICICI, HDFC, Kotak Bank etc. Their growth happened as the recommendations facilitated raising money from the capital markets. Interest rates were also de-regulated fostering competition between banks and modernisation and technology upgradation were accelerated.

Describing his contributions to the World Bank Board, Dr Robert McNamara said, “Your dedication, your consistently thoughtful and informed views, your careful judgement, your breadth of vision and your dogged hard work have all combined to set a standard of service on the Board that deserves the gratitude, not only of India and your constituencies but of the entire development community itself”, according to the History of RBI publication.

In Hyderabad and ASCI

Maidavolu Narasimham took voluntary retirement from government sometime in the late 1990s and joined as the Principal of the Administrative Staff College of India (ASCI), Hyderabad. He later served a long innings as Chairman of the Court of Governors till about 2015, leaving a lasting impression on the Institute.

The ASCI was one of my favourite places for getting stories as a journalist. Centrally located, with the charming and historic buildings called Bella Vista, it was a centre of hectic activity. After Prime Minister, Rajiv Gandhi visited it in 1987, during the tenure of Dr Dharani Sinha, ASCI was given the high profile role of training MPs too.

Though, I heard Mr Narasimham many times on assignments, it was sometime in 2004, that I got the challenging task of interviewing him on banking reforms for The Hindu BusinessLine, which was celebrating its 10th year of publication, with a series of articles/interviews on the various facets of the India economy. Me and my colleague, Ch Prashanth Reddy conducted the interview in his chambers at the ASCI.

To the credit of Mr Narasimham, he put us to ease quickly and answered our questions patiently, precisely and perceptively. Our burden was reduced by our senior editor from Mumbai, Mr P Devarajan, a banking specialist, who briefed us in advance. The interaction turned memorable indeed and his views were well appreciated.

Personal life and career

Mr Narasimham hailed from Guntur district in Andhra Pradesh. Born on June 3, 1927 to Shanthy Sundaresan and Maidavolu Seshachelapati. He completed his education from Presidency College, Madras and went on to study at the St John’s College, Cambridge, UK. He joined the RBI in 1950.

An interesting anecdote related to his marriage from his memoirs From Reserve Bank to Finance Ministry and Beyond, Narasimham says “In May 1953 Shanti and I were married. She was the daughter of N Sunderesan, who as senior deputy governor had grilled me thoroughly during my interview before joining the Bank. A few weeks later I asked Mr Sunderesan whether when I was being interviewed by him prior to my recruitment, he was interviewing a potential recruit to the RBI or a prospective son-in-law. In his characteristic and blunt manner, for which he was known, he said “Both”.

Recalling his association for nearly a decade at the ASCI, Dr Yerram Raju, a noted banker and risk analyst, says “Dr Narasimham was a stickler for punctuality. He had a sharp wit. He was a man of few words, which were more in the nature of directives. Another hallmark was his forward thinking and engaging intellectually on contemporary issues and challenges.”

Mr Narasimham who also served as secretary in the Ministry of Finance between 1982 and 1983 was awarded the Padma Vibhushan in 2000.

Somasekhar Mulugu, former Associate Editor & Chief of Bureau of The Hindu BusinessLine, is a well-known political, business and science writer and analyst based in Hyderabad