New Delhi: With prices of petrol and diesel soaring high, Minister of State (MoS) for Finance Shiv Pratap Shukla on Wednesday suggested that imposing Goods and Services Tax (GST) on fuel price will not be possible until and unless all state finance ministers agree.

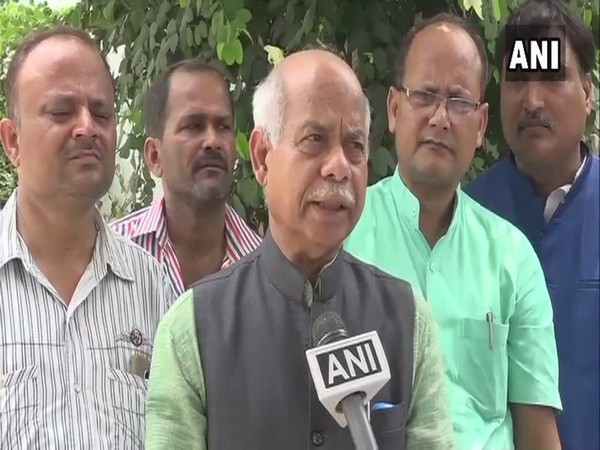

“Crude is imported. Foreign companies are raising price. Petroleum Minister has said petrol and diesel should be brought under GST. Point is, it can’t be brought before the Council until and unless all state finance ministers agree,” Shukla told ANI here.

Shukla further assured that Prime Minister Narendra Modi is looking into the matter seriously.

Earlier in the day, former Union Finance Minister P. Chidambaram claimed that the rates can be reduced by Rs. 25 per litre, but the government is not doing so.

“It is possible to cut up to Rs 25 per litre, but the government will not. They will cheat the people by cutting price by Re 1 or Rs 2 per litre of petrol,” he said in a tweet.

Petrol prices rose by 30 paisa in most metropolitans earlier today. In Mumbai, they touch Rs. 85 per litre, whereas in New Delhi, the rate has crossed Rs. 77 for a litre, fuming the general public.

Petrol and diesel prices vary from state to state depending on the factors like VAT and local sales tax.

Analysts believe that the less production of oil in the OPEC (Organization of the Petroleum Exporting Countries) and hike in crude oil price in the international market are some of the factors affecting the fuel price.

Earlier on Tuesday, All India Petroleum Dealers Association president Ajay Bansal said that they can only control the rising fuel price by reducing VAT of state and central taxes.

ANI