NEW DELH: With an eye on the upcoming Lok Sabha elections, the government may consider raising interest rates applicable to select small savings schemes popular among the economically weaker sections (EWS) and farmers in rural and semi-urban areas of the country.

Sources said the Finance Ministry is currently evaluating the small savings schemes for raising the rates and once decided, the changes may be implemented in the first quarter of the next financial year.

The plan to revise rates for small savings schemes comes close on the heels of the Employees’ Provident Fund Organisation (EPFO) announcing its proposal to increase interest rate to 8.65 per cent from 8.55 per cent on provident fund deposits for 2018-19 in complete reversal to the market trend where rates are expected to fall after the cut in policy rate by the Reserve Bank of India (RBI).

Once implemented, the changes would benefit retired pensioners, elderly persons, farmers and those who mainly depend on interest income from small savings schemes.

Though the quantum of interest rate hike and the choice of schemes for this exercise are still being worked out, official sources said the revision could take place close to the announcement of election dates, as the move is likely to benefit lakhs of small savers in the country.

Once the election dates are announced, the government and the political parties cannot announce any welfare scheme under the Model Code of Conduct.

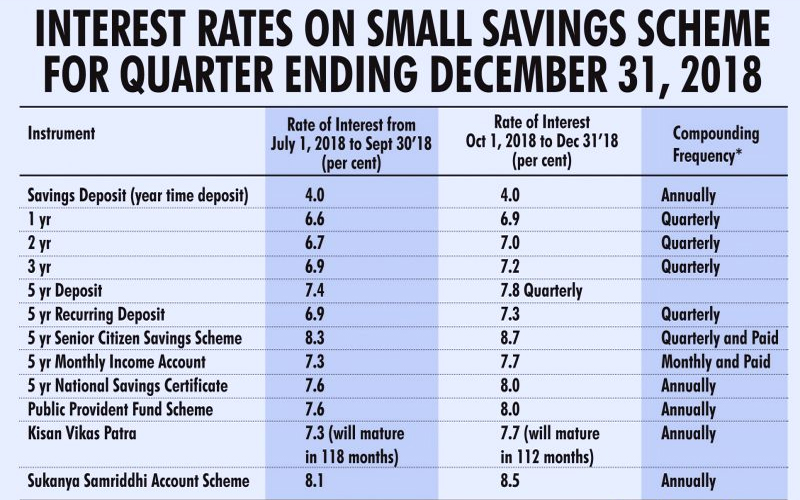

Interest rates on small savings schemes are reviewed periodically and the last hike was announced in September 2018 for the third quarter (October-December).

[also_read url=”https://www.siasat.com/news/govt-infuse-rs-83000-crore-public-sector-banks-1448287/”]Govt to infuse Rs 83,000 crore in public sector banks[/also_read]

According to a circular issued by the Finance Ministry in September last year, the interest rates on various small savings schemes were hiked by 30 to 40 basis points.

The interest rates on one-year, two-year and three-year time deposits were hiked by 30 basis points. The rates on other schemes such as the five-year time deposit, Sukanya Samriddhi Yojana and Public Provident Fund (PPF) were increased by 40 basis points.

After the hike, PPF and National Savings Certificate (NSC) earn 8 per cent, the Sukanya Samriddhi Yojana fetches 8.5 per cent while the Senior Citizens’ Savings Scheme gets 8.7 per cent. Only the rate for Post Office savings deposits was kept static at 4 per cent with no revision.

At this stage, the scope for further hike in interest rates on these schemes is limited and rate hike, if any, would only be marginal, in line with the changes made by the EPFO. Sources said that schemes that are currently drawing less than 7.5 per cent could be set for a hike.

Official sources said the rates on these small savings schemes are linked to the yields of government bonds of the same maturity and are calculated by adding a mark-up to the average of the government yield in the preceding quarter. Long-term bond yields have witnessed a sharp drop from levels of 8.15 per cent (10-year G-Sec) to 7.32 per cent.

While the government is looking to make popular changes ahead of the Lok Sabha polls, for the banks any decision to raise rates would be a double whammy. With the RBI trying for a lower rate regime, if the rates are hiked for small savers, it would be seen as going against the direction given by the banking regulator.

After the RBI effected 0.25 per cent reduction in repo rates, banks were reluctant to pass on the resultant cut in interest rates to the customers. As a result, home loan rates still have not fallen as the bankers say that passing on the full rate cut benefits affects their source of revenue and they have no headroom for offering lower interest rates.

The lenders also say that banks must provide for non-performing assets (NPAs) in the profit and loss account, and lower rate of interest robs them off that opportunity.

According to them, to offer lower interest rates, the banks will have to lower deposit rates as well. If most of the small savings schemes become attractive, the banks fear that savings will shift to these schemes, thereby further straining their deposit base and overall financials.

(Anjana Das can be contacted at anjana.d@ians.in)