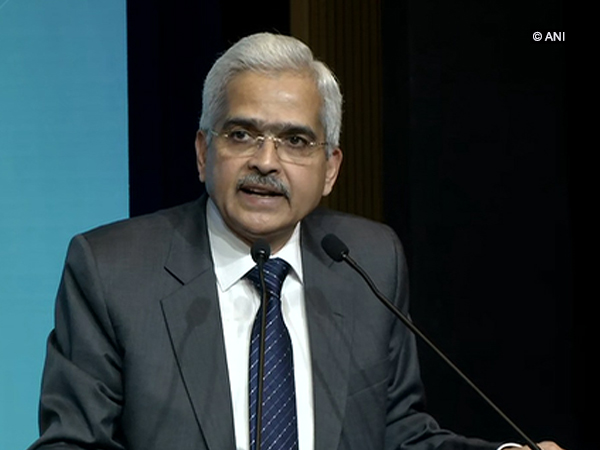

New Delhi: The Reserve Bank of India (RBI) will set up a regulatory sandbox to benefit financial technology (Fin-Tech) companies by way of reduced time to launch innovative products at a lower cost, Governor Shaktikanta Das said on Monday.

The guidelines will be issued in the next two months, he said while addressing the FinTech Conclave 2019 organized here by NITI Aayog.

“Fin-Tech has the potential to reshape financial services and financial inclusion landscape in India in fundamental ways. It can reduce costs and improve access and quality of financial services,” said Das.

“We have to strike a subtle balance between effectively utilizing fin-tech while minimizing its systemic impacts.

By enabling technologies and managing risks, we can help create a new financial system which is more inclusive, cost effective and resilient.”

The RBI has already appointed a five-member committee under the chairmanship of Nandan Nilekani to deepen digital payments and enhance financial inclusion through fin-tech.

Das said the National Electronic Funds Transfer (NEFT) system handled 195 crore transactions valued at about Rs 172 crore in 2017, growing by 4.9 times in terms of volume and 5.9 times in terms of value over the past five years.

Similarly, the number of transactions with credit and debit cards was 141 crore and 334 crores. Pre-paid payment instruments recorded a volume of about 346 crore transactions valued at Rs 1.4 lakh crore.

“Thus total card payments in volume terms stood at 52 percent of the total retail payments during 2017-18,” said the RBI Governor adding that data confidentiality and customer protection are major areas that need to be addressed.

“It is imperative to create an ecosystem which promotes collaboration while carefully paying attention to the implications that it has for macro-economy,” he said.

More than 300 representatives from leading financial institutions, state governments, micro, small and medium enterprises

(MSMEs) and industry experts participated in the conclave.

The Indian fin-tech ecosystem ranks as the third largest globally, attracting nearly 6 billion dollars in investments since 2014.

Industry research shows that about 1 trillion dollars, or 60 percent, of retail and SME credit, will be digitally disbursed by 2029.

[source_without_link]ANI[/source_without_link]