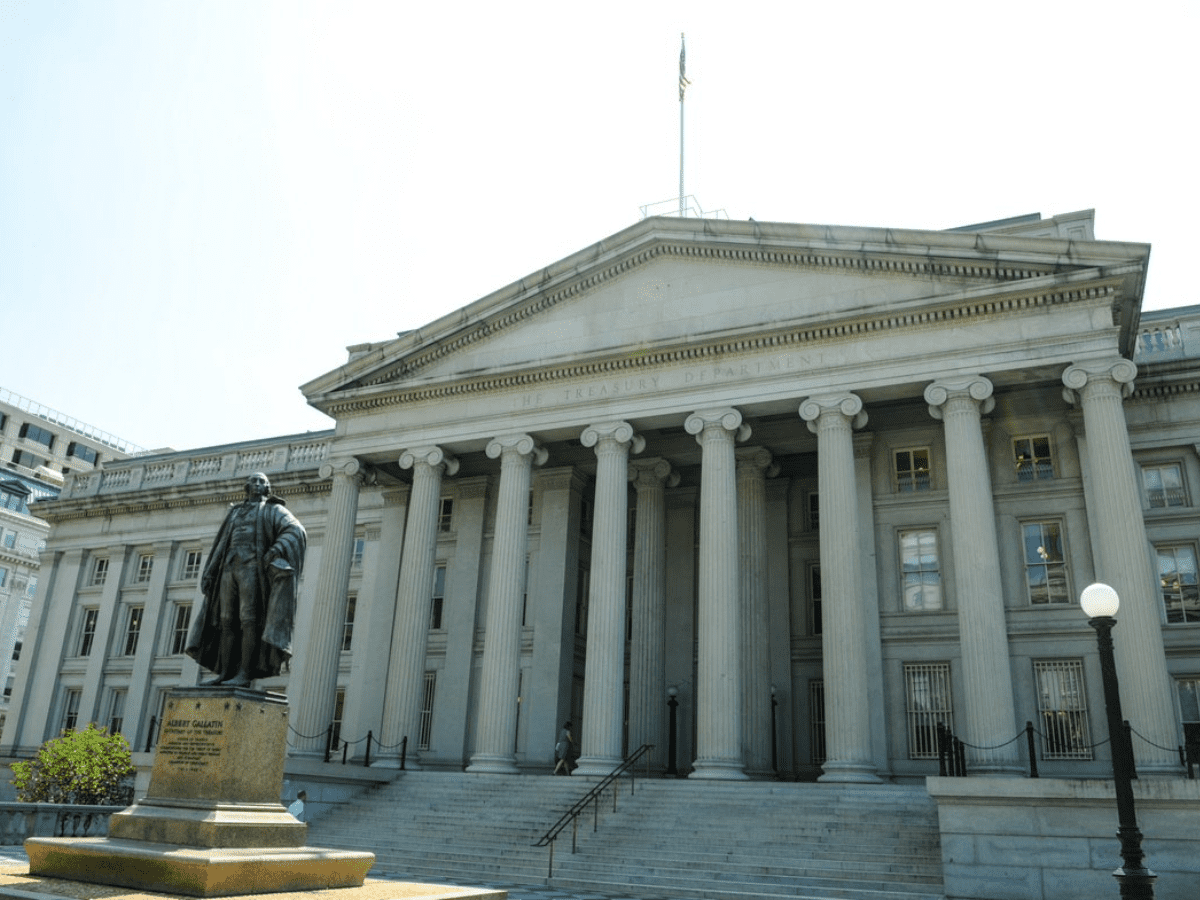

Washington: The US Treasury Department said the country could default on its debt as soon as June.

The US will reach the debt limit on January 19 on January 19 and then “extraordinary measures” will need to be taken, Treasury Secretary Janet Yellen wrote in a letter to House Speaker Kevin McCarthy.

She said that the Treasury Department will pursue those measures, but they will only last a limited amount of time, CNN reported.

It is unlikely that the government will exhaust its cash and the “extraordinary measures” before early June, though she said there is “considerable uncertainty” around that forecast.

Yellen urged lawmakers to “act in a timely matter” to increase or suspend the debt limit.

“Failure to meet the government’s obligations would cause irreparable harm to the US economy, the livelihoods of all Americans, and global financial stability,” CNN quoted the Treasury Secretary as saying in the letter.

The debt limit is the maximum that the federal government is allowed to borrow after Congress set a level more than a century ago to curtail government borrowing.

Congress has in the past raised the debt limit to avoid a default on US debt that economists have warned would be a “financial Armageddon”. That’s what lawmakers did in late 2021 following the last standoff over the debt ceiling.

The immediate measures include some accounting maneuvers involving the Civil Service Retirement and Disability Fund, the Postal Service Retiree Health Benefits Fund, and the Federal Employees Retirement System Thrift Savings Plan.

Yellen’s letter reinforced that the debt ceiling limit is an issue that Congress will have to deal with soon, CNN reported.

But it’s not an immediate problem, experts said.

“This is not the time for panic. We are many months away from the US being unable to meet all of its obligations,” said Shai Akabas, director of economic policy at the Bipartisan Policy Center.

“But it is certainly a time for policymakers to begin negotiations in earnest.”

Just how long the Treasury Department can continue the “extraordinary measures” will depend in part on how much 2022 tax revenue the government collects this spring.

Also, inflation and interest rates have risen faster than some experts estimated last year, and new policies, including the student loan forgiveness program, were introduced, potentially shortening the window.