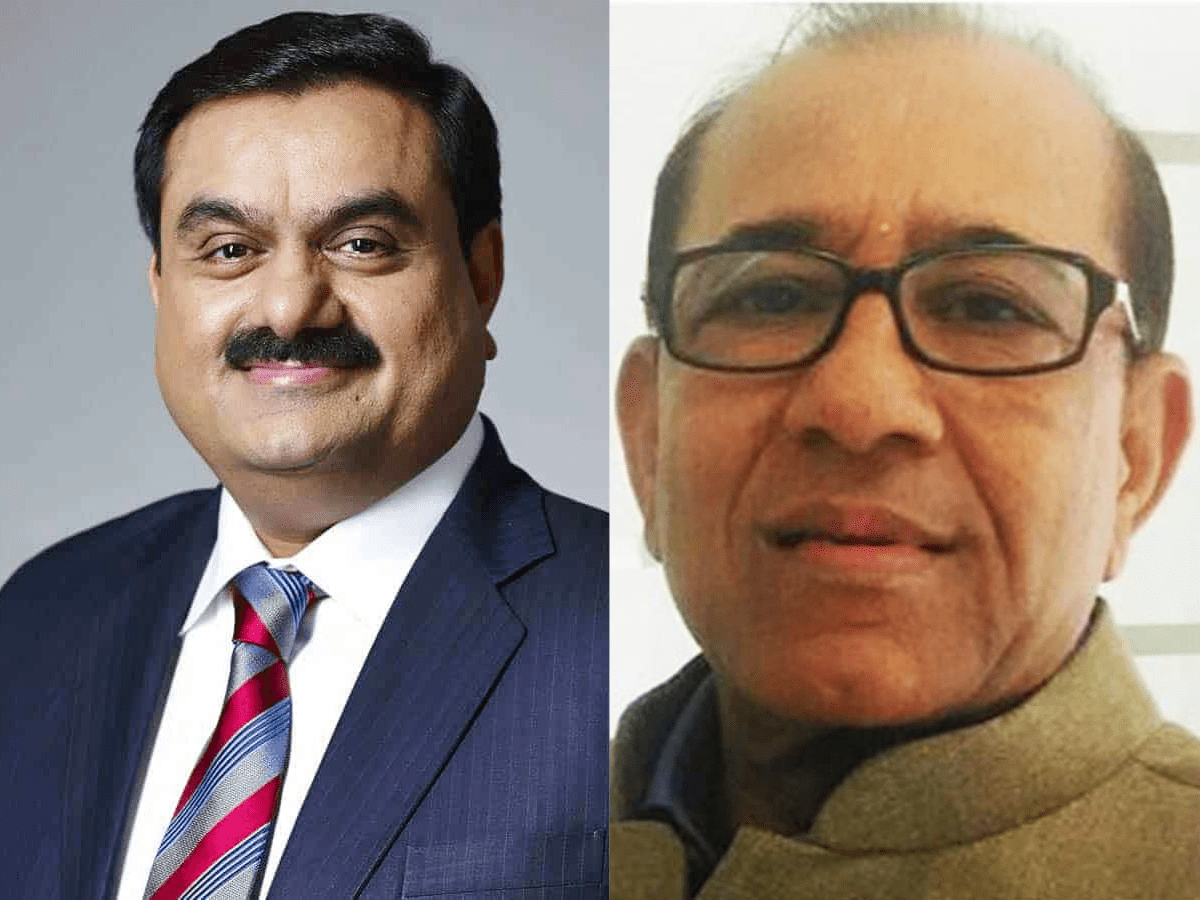

New Delhi: The Congress on Sunday alleged that Gautam Adani’s elder brother Vinod Adani is at the centre of financial flows that leverage one group of Adani assets to send loans to another, and asked if this was not worthy of an investigation by the SEBI and the Enforcement Directorate.

Posing a set of three questions to Prime Minister Narendra Modi as part of the party’s “Hum Adani ke Hain Kaun” series, Congress general secretary Jairam Ramesh alleged that the Adani group has made “misrepresentations” about Vinod Adani’s central role in its “nefarious activities”.

Recently, Adani Group stocks had taken a beating on the bourses after US-based short seller Hindenburg Research made a litany of allegations, including fraudulent transactions and share-price manipulation, against the business conglomerate whose chairman is Gautam Adani.

The group has dismissed the charges as lies, saying it complies with all laws and disclosure requirements.

“Just because the PM is ‘Mauni Baba’ on this issue (like on Chinese incursions) it doesn’t mean we stop asking questions of him. Here is HAHK (Hum Adanike Hain Kaun)-14,” Ramesh said on Twitter and posted another set of three questions to the prime minister.

In his statement addressed to Prime Minister Modi posted on Twitter, Ramesh cited allegations made by Hindenburg Research claiming that Vinod Adani “manages a vast labyrinth of offshore shell entities” that have “collectively moved billions of dollars into Indian Adani publicly listed and private entities, often without required disclosure of the related party nature of the deals”.

In its January 29 reply to the charges, the Adani Group stated that “Vinod Adani does not hold any managerial position in any Adani listed entities or their subsidiaries and has no role in their day to day affairs”, Ramesh pointed out.

“Despite the Adani Group’s claims distancing itself from Vinod Adani, in repeated public filings the group has described Vinod Adani as an intrinsic part of the Adani Group. For instance, this memorandum filed with the Bombay Stock Exchange in 2020 for a Rs 400 crore debt private placement clearly states: ‘Adani Group means S.B. Adani Family Trust, Adani Properties Private Limited, Adani Tradeline LLP, Gautam Adani, Rajesh Adani, Vinod S. Adani and all companies and entities controlled directly or indirectly by S.B. Adani Family Trust or Adani Properties Private Limited or Adani Tradeline LLP or Gautam Adani or Rajesh Adani or Vinod S. Adani, separately or collectively,” the Congress leader claimed in his statement.

Posing questions to Prime Minister Modi, Ramesh asked why is his “close friend lying so blatantly” to investors and to the public.

“Are the various investigative agencies that you have freely deployed against political parties, media and non-subservient businesspersons ever going to be used to investigate your cronies even when they are caught red-handed?” Ramesh asked.

On September 16 last year, the Adani Group announced that the Adani family, through Endeavour Trade and Investment Ltd, a special purpose vehicle, has successfully completed the acquisition of Ambuja Cements Ltd and ACC Ltd, he said.

The acquisition catapulted Adani to the rank of India’s second-largest cement producer, Ramesh noted.

“The acquirer’s SEBI filing stated in no uncertain terms that ‘the ultimate beneficial ownership of the acquirer is held by Mr. Vinod Shantilal Adani and Mrs. Ranjanben Vinod Adani’. Is it not a laughable falsehood for the Adani Group to now distance itself from Vinod Adani?” he said.

“An Australian investigation has shown that Vinod Adani’s Pinnacle Trade and Investment, based in Singapore, controls a number of Adani Group assets in Australia. In 2020, Pinnacle entered into a USD 240 million loan agreement with Russia’s now sanctioned VTB Bank, and then went on to lend USD 235 million to a related party, likely connected to the Adani Group according to Forbes magazine,” Ramesh alleged.

Does this not clearly show that Vinod Adani is at the centre of financial flows that leverage one group of Adani assets to send loans to another, as alleged by Hindenburg, he asked.

“Is this not worthy of investigation by SEBI and the Enforcement Directorate?” the Congress general secretary said.

The Congress has demanded a joint parliamentary committee probe into the Adani issue. The opposition party had also stalled proceedings of both Houses of Parliament during the first part of the Budget Session.