Gautam Adani again began climbing up on the world’s billionaire list as his net worth soared following the rise in his companies’ stocks. Today, he emerged as the top winner on the world’s rich list.

The businessman who recently slipped out of the world’s top 20 billionaires list is currently at the 17th spot. His current net worth is USD 63.4 billion.

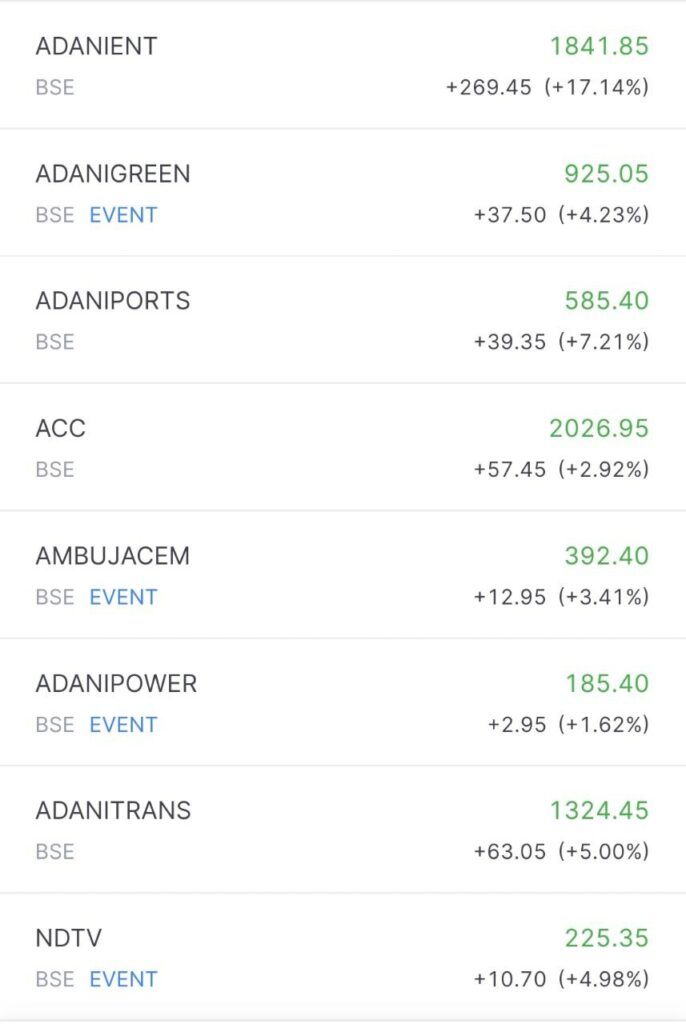

As of now, all of the Adani Group stocks are trading in green. The highest surge is seen in Adani Enterprises shares which are up by over 17 percent.

All Adani Group companies’ stocks trade in green

The stocks of Adani Group companies that were bleeding for the past few days due to the Hindenburg research report are now witnessing a reversal as all of them are trading in green.

Apart from Adani Enterprises, Adani Green, Adani Ports, Adani Transmission, and NDTV stocks witnessed a more than four percent hike.

The stocks of other Adani Companies such as ACC, Ambuja Cements, Adani Power are also trading in green.

From top loser to winner in the billionaire list

Adani who emerged as the top loser yesterday see rise in net worth today. In one day today, his net worth surged by USD 2.2 billion.

Today’s top five winners

| Name | Current net worth (in billion USD) | Change in net worth (in million USD) | Change in net worth (in percentage) | Country |

| Elon Musk | 187.3 | +3000 | +1.65 | US |

| Gautam Adani | 64.3 | +2400 | +3.87 | India |

| Tadashi Yanai | 32.1 | +708 | +2.25 | Japan |

| Ravi Jaipuria | 8.3 | +642 | +8.34 | India |

| Low Tuck Kwong | 27.6 | +617 | +2.29 | Singapore |

Today’s top five losers

| Name | Current net worth (in billion USD) | Change in net worth (in million USD) | Change in net worth (in percentage) | Country |

| Bernard Arnault | 217.5 | -4000 | -1.80 | France |

| Larry Page | 88.8 | -1400 | -1.57 | US |

| Francois Pinault | 40.8 | -1400 | -3.27 | France |

| Sergey Brin | 85.1 | -1300 | -1.55 | US |

| Jeff Bezos | 125.3 | -1200 | -0.95 | US |

Reason for rebound in Adani group stock prices

One of the major reasons for the surge in Adani stocks is the announcement by Adani Group promoters to prepay USD 1.114 billion for the release of share-backed loans ahead of maturity in September 2024.

This, the group said, is in continuation of the promoters’ assurance to prepay all share-backed financing and also is in light of recent market volatility.

Among the companies of which the group will release shares are 168.27 million shares, representing 12 percent of the promoters’ holding in Adani Ports and Special Economic Zone Ltd, 27.56 million shares, representing 3 percent of promoters’ holding in Adani Green Energy Limited, and 1.77 million shares, representing 1.4 percent of promoters’ holding in Adani Transmission Limited.

Another reason is Adani Transmission’s profits rise by 73 percent in the December quarter. The company on Monday announced its earnings data for the October-December 2022 quarter. Its profit after tax rose 73 percent on a yearly basis to Rs 478 crore during the December quarter.

Last but not least is the upcoming announcement of the Q3 earnings of the group’s companies.

Net worth of Adani

The Hindenburg Effect has caused a significant drop in Gautam Adani’s net worth, which was USD 134.2 billion on December 13, 2022, but now stands at USD 63.4 billion.

Due to the continuous fall in the stocks of the group firms, the gap between the net worths of Gautam Adani and Reliance Industries Limited (RIL) chairman Mukesh Ambani has widened.

Ambani has regained his title as the richest person in India as of February 1 and is currently ranked 12th on the world’s billionaire list. His net worth is USD 82.5 billion.