By Siddhant Thakur

Hyderabad: When Prime Minister Narendra Modi announced the demonetisation of Rs 500 and Rs 1000 notes in 2016, it disrupted business and commerce in India on an unprecedented scale. Four years later, even before the economy could fully recover, the COVID-19 pandemic wreaked more havoc as literally, everything in the nation had to shut shop.

Both demonetisation and the COVID-19 pandemic also led to one major change; in the adoption of online payments in lieu of cash. This has in fact affected the small group of torn currency exchangers, whose entire business model depends on the physical circulation of cash, which has in general now reduced (most establishments now have some form of UPI/online payment option for customers these days).

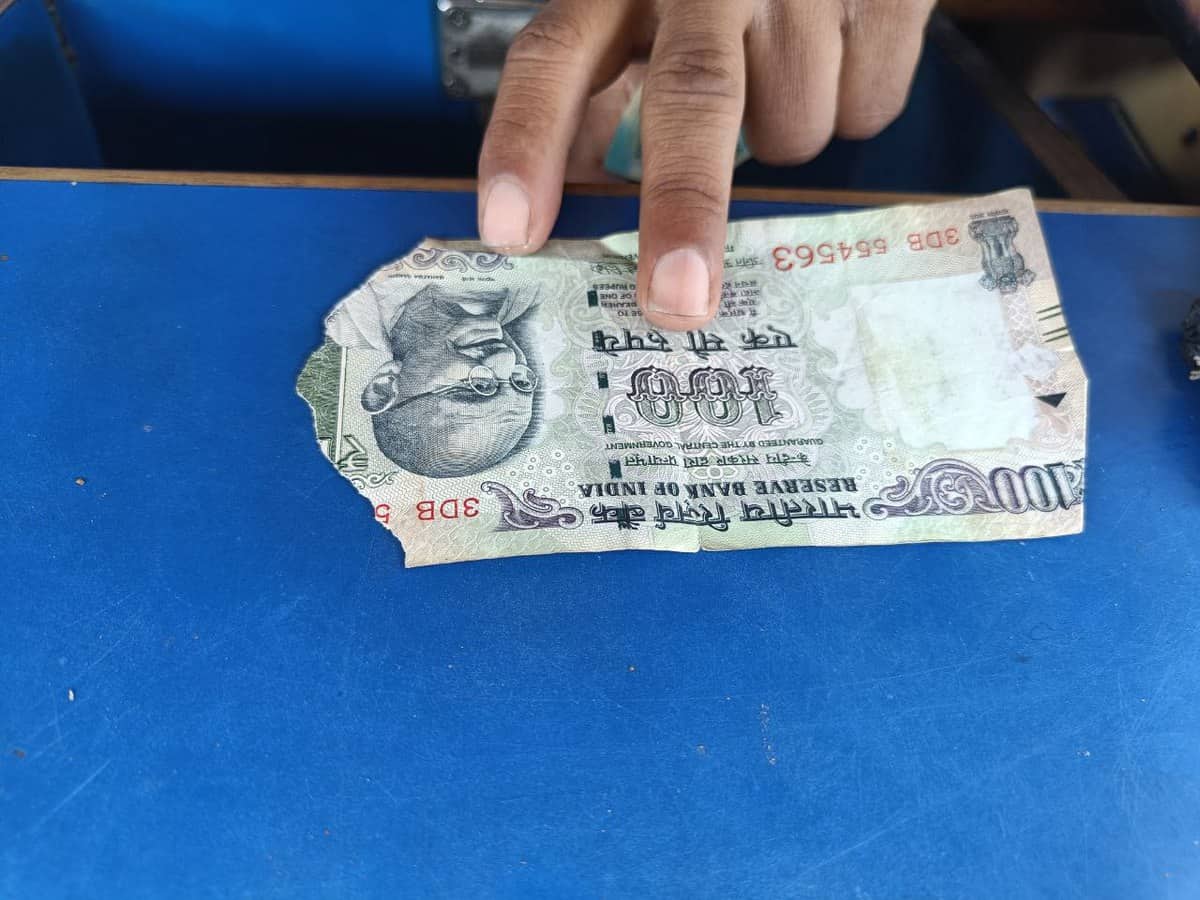

Torn currency note traders have been perhaps the worst affected in recent times. Currency notes that are soiled, brittle, burnt, charred, and partially mutilated are collected from several local establishments, or anyone else as well, whose owners get back a little less for these damaged notes.

The way the business works is like this: When a person comes with a torn note they are given 70%-80% of the amount depending on the condition of the note. The trader then exchanges the note with a middleman or the Reserve Bank of India and makes his profit.

Talking to siasat.com, Mohammed Farooq, a torn note trader who has been doing the business for the past 20 years along with a pan shop near Malakpet railway station said “Demonetization hit my business really hard. These online payment apps have also affected my business as people doing the transaction with notes has gone down.”

There are two ways these torn currency notes are exchanged by the traders. The first way is that these traders directly go to the Reserve Bank of India (RBI) and the second way is that traders have middlemen who do the job for them.

Farooq does his business with middlemen to make his profit. “I don’t go to the RBI because they do not take more than 5000 rupees and moreover the profit what we make is also very low. It is a waste of petrol and time for me,” he told Siasat.com.

Since demonetisation in 2016, the laws to exchange the notes have also been changed, said traders, making business hard to run for them. “Previously I use to accept notes which were in more than 5 pieces as well. I can’t do that today and even if I take them I won’t make much profit,” noted Farooq.

Another torn currency note trader, Mohammed Ajaz Ur Rehman, who has been doing this business since 1983 in front of Mecca Masjid, Charminar, shared a similar story about how COVID-19 changed his business. “During the lockdown, we had to shut the business and we ran into losses. I directly go to the RBI to exchange torn notes,” he added.

Traders like him who directly go to the RBI have had a really tough time doing as the RBI has been closed for business for almost 3 years now. Ajaz said, “To make a decent profit today I am forced to send the torn notes to Nagpur as the RBI is functioning there,” he told Siasat.com, and added that even the profit margin for him now is very low when compared to the pre-pandemic period.

In spite of these hardships, traders who have to make a decent profit, have been forced to take higher percentages from their customers, meaning that whoever has a torn note now will lose a lot more in value. ”There was a time when my customers would get back about 80-90% of the value of their torn notes, but now I am forced to take 30%” for my survival,” added Ajaz.

These torn note traders are relevant even today because of the ease of doing the business. According to Farooq, people prefer giving their torn notes to local traders because it’s easy to exchange notes with them when compared to a bank.

“If you go to a bank there’s a good chance that one will have to stand there for a long time in order to exchange the torn notes. Moreover, banks exchange these notes only if you have a running account in that bank,” stated Farooq.