In a groundbreaking initiative, banks and financial institutions in the United Arab Emirates (UAE) will soon begin the rollout of a new payment card called Jaywan in a phased manner.

The announcement was made by Abdulaziz Al Ghurair, chairman of the UAE Banks Federation (UBF) during a media briefing on Tuesday, May 14, at the Mashreq Bank headquarters in Dubai.

Al Ghurair said that the Jaywan aims to gradually replace the existing 10 million-plus debit cards in the market within two and a half years, the Emirates News Agency (WAM) reported.

He further said that banks will issue new cards in stages to eliminate the need for other branded cards and enable local Jaywan card issuance.

The adoption of this system and new cards is expected to reduce expenses for businesses between Dirham 600 million and Dirham 1 billion, considering pricing or discount fees, he added.

Al Ghurair predicts Jaywan will be accepted at the GCC level and subsequent country-to-country agreements with China, India, and other nations in the future.

In February this year, Jaywan was announced during Indian Prime Minister Narendra Modi’s visit to the UAE.

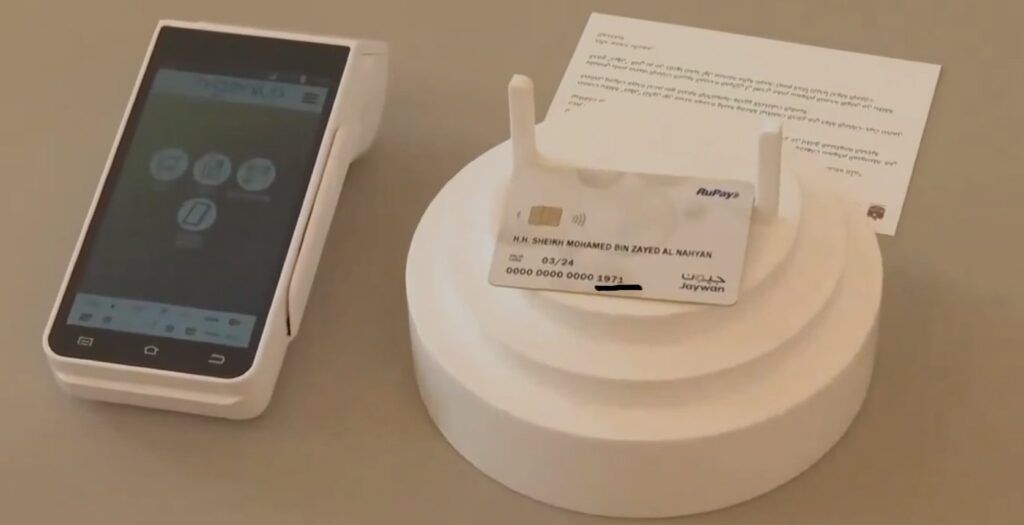

The two countries agreed to link their instant payment platforms, UPI and AANI, to increase the acceptance of credit and debit RuPay cards in both countries.

As per a report by Khaleej Times in February, the rollout of Jaywan cards is scheduled to start in the second quarter of this year.

What is Jaywan?

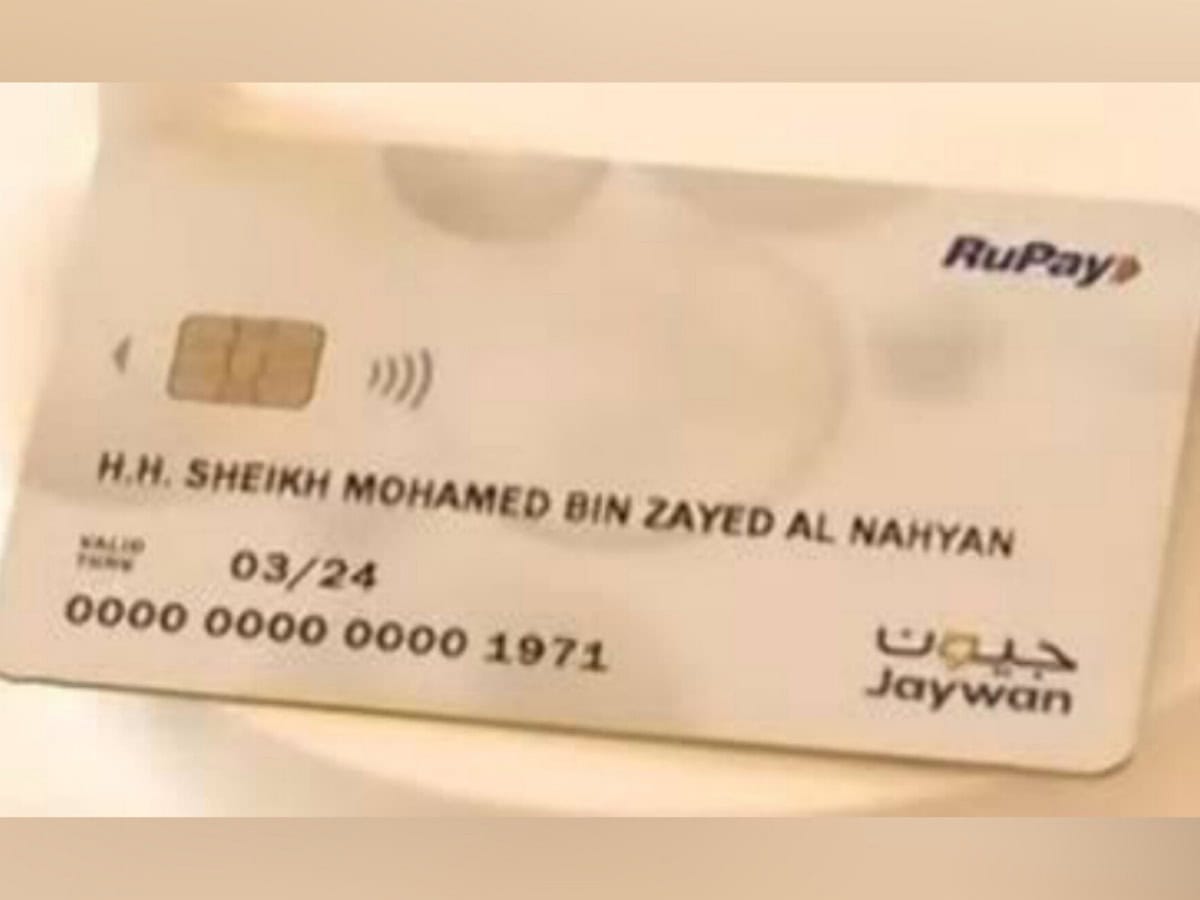

The Jaywan, developed in partnership with India’s RuPay digital credit and debit card infrastructure, is specifically tailored for the UAE market.

UAE residents and exchange house customers will receive Jaywan cards under a new payment scheme, which will also be accessible in India once electronic linkages are established.

How will Jaywan benefit Indian expats?

The linked domestic card system between India and the UAE, RuPay and Jaywan, will reduce currency risks and improve travel by eliminating the need for large cash or multiple cards, allowing transactions in local currencies, Khaleej Times reported.

The Jaywan card, integrated with the RuPay network, offers similar functionalities to UAE local cards like Emirates NBD Classic and Dubai Islamic Bank Classic, potentially gaining wider acceptance for cross-border transactions.

Purpose of launching Jaywan

The initiative aims to boost trade between India and the UAE through digital transactions and financial inclusivity, focusing on Indian residents’ needs through affordable payment solutions.