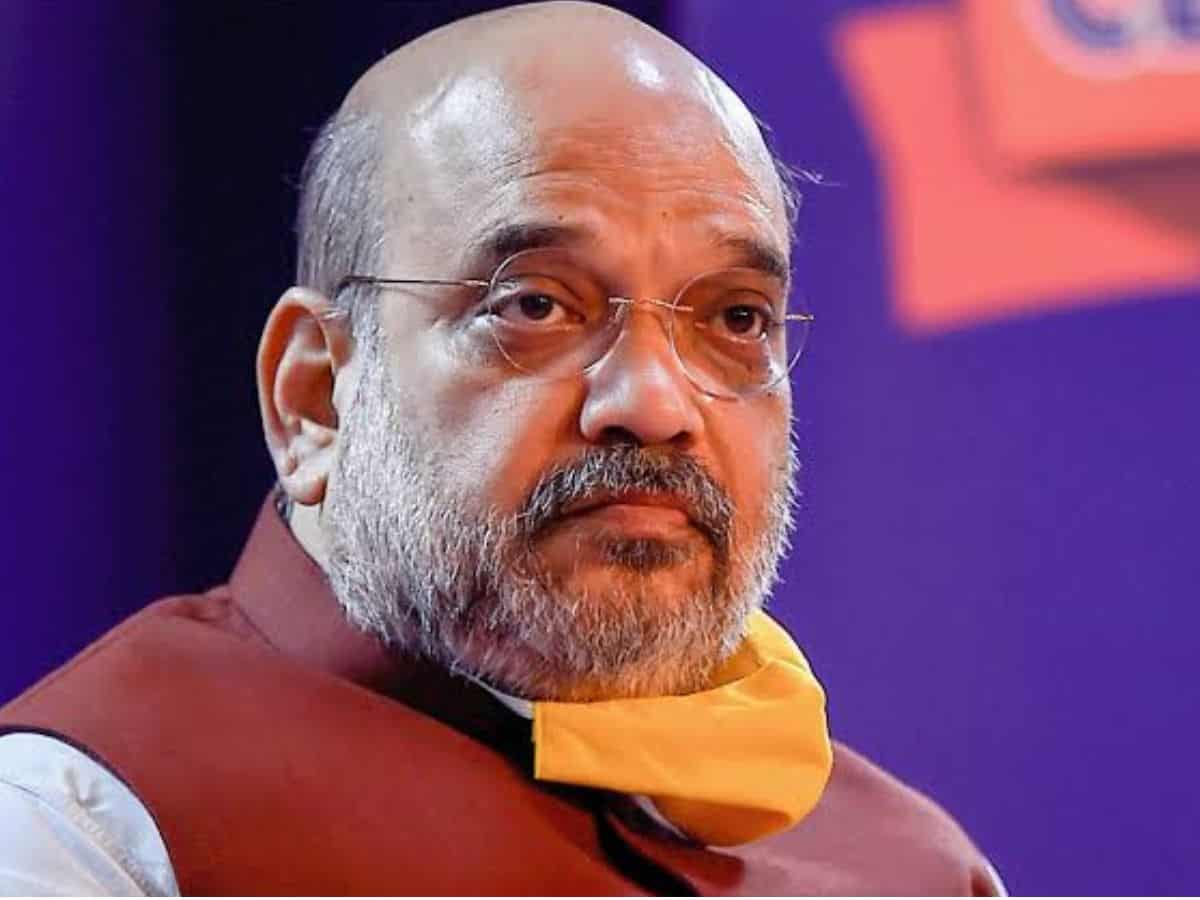

Gandhinagar: Union Home and Cooperation Minister Amit Shah on Saturday said dairy cooperatives in the country should “move 100 percent towards e-business”, and a pilot project undertaken by the district dairy cooperatives in Panchmahal and Banaskantha in Gujarat in this regard should be replicated elsewhere.

He was speaking here after virtually laying the foundation stone of the National Cooperative Dairy Federation of India’s (NCDFI) headquarters at Anand in Gujarat.

“I urge NCDFI members to move 100 percent towards e-business. We have begun with a small pilot project by giving KCC cards to each farmer in a couple of districts in Gujarat itself. Each farmer’s account is being transferred to a cooperative bank. The milk payments are being transferred into their bank accounts. If this model is implemented across the country, it will bring about a huge change and further accelerate India’s digital economy,” Shah told the gathering.

As part of the initiative, the district dairy cooperatives in Panchmahal and Banaskantha are providing Rupay cards to farmers with the help of the state cooperative bank, setting up ATMs in villages and transferring money in farmers’ accounts.

In Banaskantha district alone, Rs 800 crore have been deposited in farmers’ accounts so far and 193 ATMs set up, and 96 percent of farmers have got Rupay cards.

“The cooperative sector cannot develop unless there is cooperation between cooperatives,” Shah said.

“If we decide that the accounts of tehsil cooperative societies, farmers, businessmen and APMCs (Agriculture Produce Marketing Committees) should all be in cooperative banks, and if Amul (dairy product brand of the Gujarat Cooperative Milk Marketing Federation) takes loans from the Gujarat State Cooperative Bank, then cooperation between cooperatives will give the sector great strength,” he added.

He has requested the chairman of the Gujarat State Cooperative Bank Ajay Patel to implement the model in every district of the state by opening accounts of every farmer and dairy cooperative society in the respective district cooperative bank, Shah said.

“That way, they will not be required to take money out of their pockets but will use a Rupay card,” he said.

Farmers do not want to evade tax, but end up facilitating the same by making payments in cash, the Union minister said, adding that cash transactions encourage informal economy.

Shah also said that when cooperatives stay away from the milk business, the sector does not grow beyond milk producers, middlemen and consumers.

When the cooperative sector enters the milk business, it provides multidimensional benefits to the local community, agriculture, village, milk producers and ultimately the country, something which India has seen for the last 50 years, Shah said.

“When the cooperative sector is involved in the milk business, the first beneficiary is the milk producer who is saved from exploitation,” he added.