New Delhi: A day after the SEBI made submissions to the Supreme Court in the Adani matter, the Congress on Tuesday said the market regulator “failed” to file any case that would trigger an Enforcement Directorate investigation.

The party reiterated only a Joint Parliamentary Committee probe could bring out the truth.

The Securities and Exchange Board of India (SEBI) on Monday told the Supreme Court that its 2019 rule changes do not make it tougher to identify beneficiaries of offshore funds, and action will be taken if any violation is found or established.

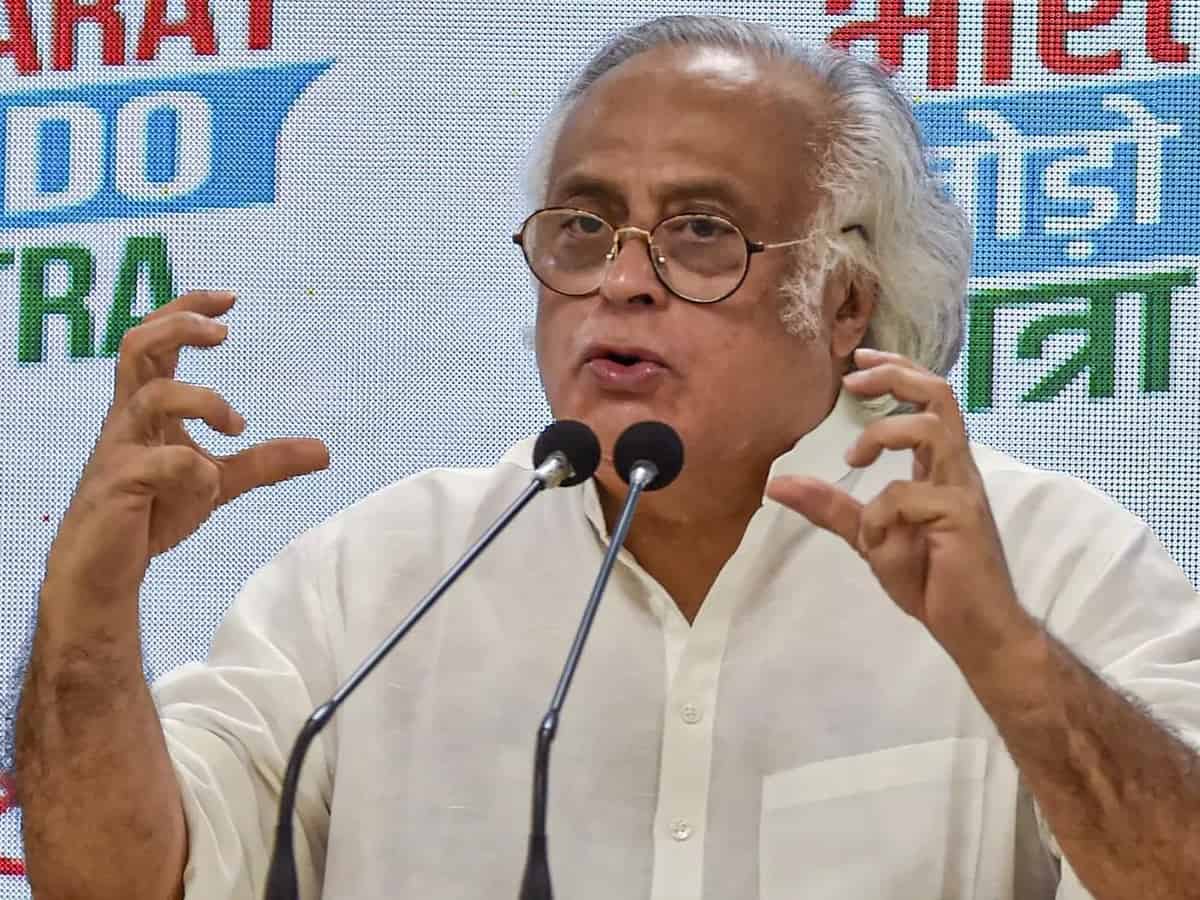

In a statement on the Securities and Exchange Board of India’s (SEBI) submission to the apex court, Congress general secretary Jairam Ramesh said the Supreme Court’s Expert Committee, claimed by some interested parties to have issued some sort of ‘clean chit’, gave damning revelations about SEBI’s inability to fully investigate the “Adani mega scam”.

The committee pointed out in its report that SEBI had in 2018 diluted and subsequently, in 2019, entirely deleted the reporting requirements relating to the ultimate beneficial (i.e. actual) ownership of foreign funds, he said.

This had tied its hands to the extent that “the securities market regulator suspects wrongdoing, but also finds compliance with various stipulations in attendant regulations It is this dichotomy that has led to SEBI drawing a blank worldwide,” Ramesh said quoting the expert committee.

“In other words, SEBI suspects that the Adani Group has violated the rules regarding minimum public shareholding using opaque overseas funds, including the widely reported Rs 20,000 crore of benami funds, but has failed to do anything about it,” the Congress leader claimed.

“All of which has been rather convenient for PM Modi and his cronies,” he added.

Ramesh said that in an affidavit to the Supreme Court, SEBI has reportedly defended itself saying that amendments to the Prevention of Money Laundering Act (PMLA) regarding disclosures of beneficial owners made its own rules redundant.

However it is “piquant” that despite its well-documented suspicions since at least 2020, the SEBI has failed to file any case that would spark an Enforcement Directorate (ED) investigation under the PMLA, Ramesh said.

Usually, hyperactive when it comes to prosecuting opposition leaders, the Modi government has been “noticeably reluctant” to use the ED to investigate the “Adani scam”, he alleged.

“PM Modi is hardly likely to wish to investigate himself or his cronies,” he said.

The fact that the SEBI board introduced stricter reporting rules on foreign ownership for certain classes of foreign portfolio investors on June 28, 2023 is a clear admission of guilt by the securities regulator, Ramesh claimed.

“Pressure from many media revelations, the expert committee’s report and the Congress party’s Hum Adanike Hain Kaun (HAHK) campaign seem to have forced SEBI’s hand,” he said.

Prime Minister Modi made a commitment before G20 world leaders in 2016 to lead efforts to “eliminate safe havens for economic offenders” and remove the “excessive banking secrecy that hide the corrupt and their deeds”, he said.

Instead, Modi has “neutered” India’s investigative agencies and facilitated the “expansion of his cronies” into every strategic sector of the economy, at the cost of competitors and taxpayers, Ramesh alleged.

The Congress leader claimed that the PM is also seeking to create new opportunities for money-laundering, such as anonymous participatory notes (P-notes) in the Gujarat International Finance Tec-City (GIFT), which regulators spent years trying to phase out.

“We await SEBI’s 14 August 2023 report and clarity on questions such as the origins of the Rs 20,000 crore of opaque foreign funds that have flowed into Adani companies. But SEBI’s investigation is limited in its scope. Only a JPC can fully investigate PM Modi’s crony links with the Adani Group and how he has personally facilitated their business in India and abroad by changing laws, rules and regulations to help his close friends,” Ramesh said.

Hindenburg Research in its January 24 report that levelled allegations of fraud, stock manipulation, and money laundering against the Adani group, had also flagged inadequate disclosures of related party transactions.

While the group has denied all allegations, the Supreme Court constituted an expert committee for assessment of the extant regulatory framework and asked stock market regulator SEBI to complete its probe into allegations.

The Congress had earlier come out with a set of 100 questions on the Adani issue and sought answers from Prime Minister Modi, asking him to break his silence on the matter.