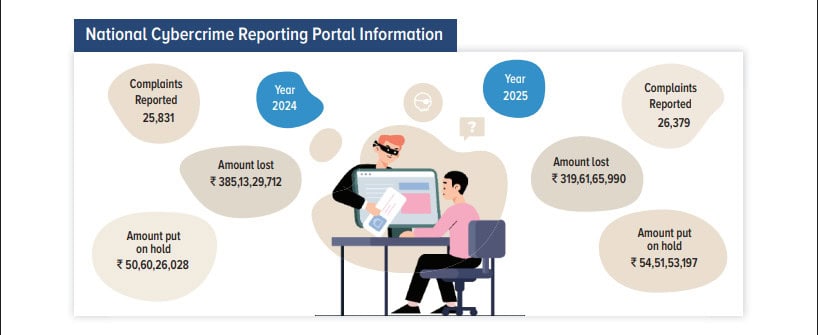

Hyderabad: Cybercrimes in Hyderabad have decreased by 8 per cent this year, with fewer cases registered than in 2024, according to the Hyderabad Commissionerate’s annual crime report released by Police Commissioner VC Sajjanar on Saturday, December 27.

Data shows that the police registered 3,735 cases in 2025, compared to 4,042 cases filed last year. There was a reported loss of Rs 319 crore in cybercrime cases throughout the year, according to the police report, which is marginally less than the Rs 385 crore lost in 2024.

With an 18% detection rate, the police arrested 566 accused, and the commissionerate officers refunded Rs 30.05 crore to the victims.

The data stated that 740 cases of investment fraud were reported in the Hyderabad Commissionerate, the highest among cybercrimes, where victims lost more than Rs 44 crore. A total of 458 one-time password (OTP) fraud cases were registered in the city, amounting to losses of Rs 11.75 crore, signifying an increase in the number of people being duped through such frauds.

Trading frauds also saw a similarly high number, with 430 cases filed, resulting in a staggering loss of over Rs 133 crore.

Digital arrest scams had particularly severe consequences, with incidents in 2025 leading to losses of Rs 33.81 crore and, in some cases, pushing victims to take extreme steps, including dying by suicide.

Customer care and job fraud together resulted in cumulative losses of more than Rs 3 crore, while 34 loan fraud cases alone recorded a loss of Rs 3.99 crore.

Meanwhile, 10 cases of honey trap or sextortion were registered in the city, with victims losing Rs 52.49 lakh, the data revealed.

The report also flagged 12 matrimonial fraud cases, with victims being duped of a total of Rs 1.27 crore, and eight WhatsApp display photo scams saw a loss of Rs 2.22 crore.

With younger online users constantly gaming online, the authorities noted four significant cases where victims lost Rs 1.64 crore.

Police issue advisory against AI fraud

With the usage of artificial intelligence (AI) on the rise, fraudsters can now use deepfake and AI-generated content to create fake voices and even videos of people you know to request money, the police warned. It is always advisable to first verify such claims with trusted sources before acting on them, they added.

Mule account gangs were also reported across the city in large numbers. Thus, giving away important information like your UPI or transaction details is a major risk, with authorities holding you accountable if your account was used for money laundering or fraud.

It is always better not to click on links from strangers, however enticing they might be. Criminals use favourable images to lure their victims and entrap them in scams. One click, and your device has now downloaded malware or an APK file, leading to substantial loss of money, the police said.

Since most betting apps operate illegally, authorities have urged citizens to be cautious, since they can take your personal information, including financial data, and sell it to other scam networks.

“Do not share OTPs, send money blindly, or fall prey to high-return offers. It is almost always a trap,” they added.