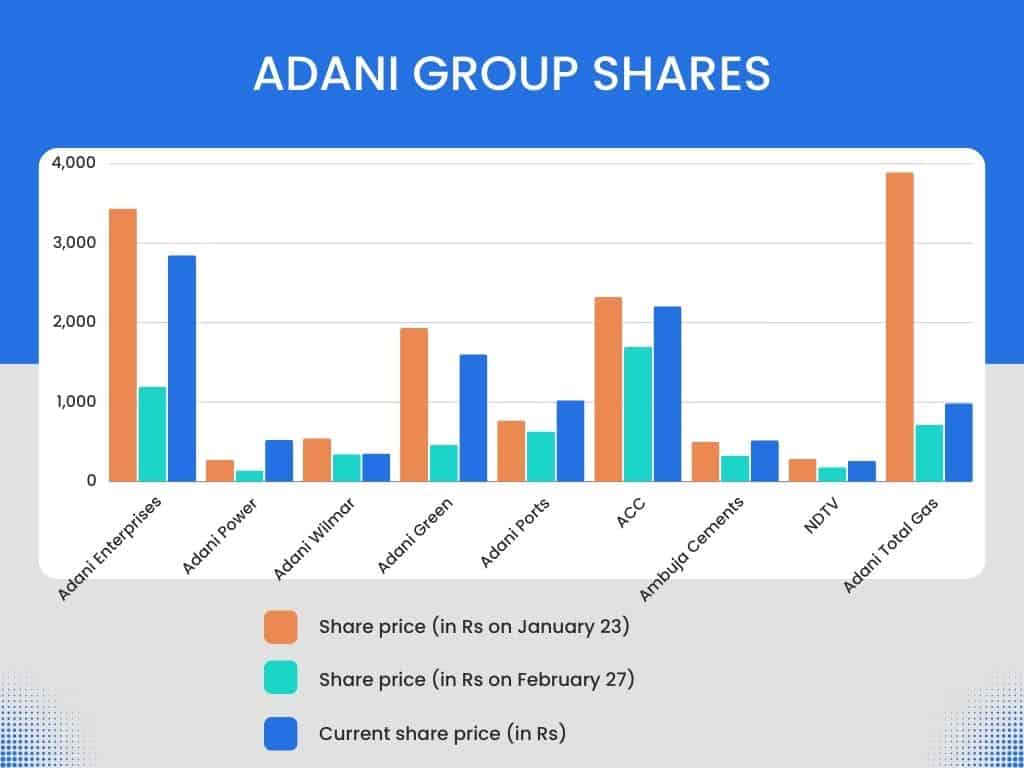

The share of Adani Enterprises, which was at Rs 3436.35 on January 23, fell to Rs 1017.45 by February 27 following the release of the Hindenburg report against the Adani group on January 24.

In about one month, the company’s share fell by over 70 percent; however, it then rose drastically.

Shares of Adani Enterprises jumped by 180 pc

From the one-year low of Rs 1017.45 recorded on February 27, it jumped to the current share price of Rs 2849.05. The share surged by over 180 percent in less than one year. Following is the fall and rise of shares of other firms in the Adani Group.

| Company name | Share price (in Rs on January 23) | Share price (in Rs on February 27) | Current share price (in Rs) |

| Adani Enterprises | 3436.35 | 1193.50 | 2849.05 |

| Adani Power | 273.20 | 139.35 | 523.00 |

| Adani Wilmar | 545.90 | 344.45 | 355.00 |

| Adani Green | 1931.85 | 462.20 | 1603.00 |

| Adani Ports | 769.05 | 629.10 | 1023.00 |

| ACC | 2323.45 | 1694.80 | 2208.00 |

| Ambuja Cements | 501.10 | 329.90 | 519.70 |

| NDTV | 284.05 | 181.10 | 262.30 |

| Adani Total Gas | 3891.75 | 714.25 | 986.80 |

Adani’s net worth, ranking in world billionaires’ list

Due to the fall in Adani Enterprises’ share and other firms in the Adani Group, Gautam Adani’s net worth dropped from USD 134.2 billion on December 13, 2022, to USD 33.8 billion on February 27.

He has not only lost his place in the 100 billion club but his ranking declined from second to 37th on the world billionaires’ list. However, from February 27, his ranking and net worth improved.

Currently, he is at the 16th position in the world billionaires’ list, and his net worth is USD 72.5 billion.