By Sejal Gupta and Anjana Divakar

India’s vast road network spans over 1.4 million km, with National Highways (NHs) comprising less than 2% of this length but managing 40% of road traffic, underscoring their critical role in connecting states and facilitating the movement of goods and services.

National Highways were initially government-managed public utilities, but limited funding in the 1990s led to the adopting of the Public-Private Partnership (PPP) model. The National Highways Authority of India (NHAI), established in 1995, has since overseen the development, maintenance, and regulation of NHs. A 1997 amendment to the National Highways Act, of 1956, enabled toll collection on NHs funded through public, private, or mixed investments. Over the past five years, toll plazas have grown annually by 10%, while road infrastructure budgets surged from Rs. 34,345 crores in 2014–15 to Rs 2,70,434 crores in 2023–24. Currently, NH projects covering 43,856 km, with investments totalling Rs. 9,60,103 crores, are under development, highlighting the sector’s rapid growth and importance.

Toll practices

India’s tolling industry plays a vital role in sustaining the country’s road network, but persistent issues demand attention. While toll systems have improved service quality and safety, concerns about deteriorating maintenance, ignored performance benchmarks, and toll collection beyond project costs fuel public dissatisfaction. A Parliamentary Standing Committee (PSC), 2024 study in Kerala highlighted irregularities, including varied toll rates, excess collections, and violations of mandated spacing between toll plazas. Toll fees also strain businesses by raising transportation costs and reducing profitability, especially for small enterprises.

Socioeconomically, they burden low-income commuters, limiting access to essential services. Traffic diversion to free roads exacerbates congestion, delays, and emissions, underscoring the need for equitable tolling and stricter regulatory enforcement.

What does the data reflect?

During a recent Lok Sabha session, Minister of Road Transport and Highways Nitin Jairam Gadkari addressed Asaduddin Owaisi’s queries on toll collection policies, costs, and revenues.

According to the data, India has over 250 NH and 715 toll sections, including 134 publicly funded projects, 279 Build-Operate-Transfer (BOT) projects, and 301 Toll-Operate-Transfer (TOT) projects.

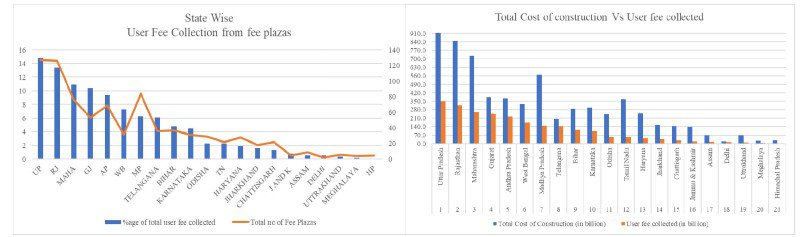

Toll collection is active at approximately 820 plazas across 655 NH sections spanning 20 states and Delhi NCR. Some states, such as Punjab, Goa, Arunachal Pradesh, Mizoram, Tripura, Kerala, Manipur, and Sikkim, are excluded from tolling data. Tamil Nadu presents a unique case where the number of toll sections exceeds the number of toll plazas in contrast with the usual pattern nationwide (Figure 1).

Figure 2: State-wise Cost of Construction of NH Sections

Source: Toll Collection on NH,2024. Ministry of Road Transport and Highways. Government of India.

Figure 4: State-wise Trend of Total Sections vs Total User Fee Collected

Source: Toll Collection on NH, 2024. Ministry of Road Transport and Highways. Government of India.

Data on NH construction offers a detailed view of investment distribution and regional disparities. Construction costs vary across states due to terrain, project complexity, and land acquisition expenses. Haryana, with just 10 sections, accounts for 3.9% of the total cost, driven by high-value projects near Delhi. In contrast, Gujarat’s higher cost per section stems from large-scale or complex projects despite having fewer sections.

The total construction cost for 655 NH sections stands at approximately Rs. 6,41760 crores. Uttar Pradesh (14%), Rajasthan (13%), Maharashtra (11%), Madhya Pradesh (9%), and Gujarat (6%) collectively dominate over 50% of the costs across 345 sections. However, costs do not always correlate with section numbers. For instance, Gujarat’s 41 sections incur higher costs per section than Madhya Pradesh’s 68 sections, reflecting project complexity or scale. Regions like Delhi (2 sections, Rs.395 crores) and Himachal Pradesh (5 sections, Rs.3,079.5 crores) report lower costs, indicating smaller project scopes or shorter stretches. Meanwhile, states with challenging terrains, such as Jammu & Kashmir, Meghalaya, and Uttarakhand, face higher costs per section due to geographic difficulties (Figure 2).

Impact on revenue generation

Toll plazas are a key revenue stream, funding road construction, maintenance, and other infrastructure like bridges and tunnels. According to government data, 820 toll plazas across India have collectively generated approximately Rs. 2,37,350 crores since toll collection began. Notably, 60% of this revenue comes from Uttar Pradesh, Rajasthan, Maharashtra, Gujarat, and Andhra Pradesh, while 30% is contributed by states like Madhya Pradesh, Telangana, Bihar, Karnataka, Odisha, Tamil Nadu, Haryana, Jharkhand, Chhattisgarh, and Jammu & Kashmir. A smaller 3% comes from Assam, Delhi, Uttarakhand, Meghalaya, and Himachal Pradesh. Despite having just 31 plazas, West Bengal collects an impressive 7% of total revenue. Madhya Pradesh, despite having numerous toll plazas, generates lower revenue per plaza compared to high-performing states like Maharashtra and Gujarat, likely due to less busy highways or shorter toll sections.

The data also highlights disparities between infrastructure investment and toll revenue. The average construction cost per state is Rs. 30630 crores, while the average toll revenue is Rs.11304 crores. Gujarat, Andhra Pradesh, West Bengal, Delhi, and Telangana stand out, with toll revenue exceeding 50% of their total construction costs. Telangana and Delhi show particularly high efficiency, collecting 70% and 69%, respectively, despite lower construction costs. In contrast, states like Uttar Pradesh (38%), Rajasthan (37%), and Maharashtra (36%) demonstrate moderate collection efficiency relative to their significant construction costs. Gujarat and Andhra Pradesh achieve a strong balance, with collection rates of 65% and 60%, respectively, reflecting efficient toll revenue generation (Figure 4).

Policy framework

Responding to queries about tolling practices, the Minister of Road Transport and Highways Nitin Jairam Gadkari emphasised that toll collection is governed by the National Highways Fee (Determination of Rates and Collection) Rules, 2008, with the government authorised to impose user fees on highway sections, including bridges, bypasses, and tunnels. Collection must begin within 45 days of completing any section, and toll rates are fixed in agreements with private investors, even if construction costs exceed initial estimates, ensuring funding for maintenance and expansion. Recent reports from PSC and CAG audits call for reforms to improve tolling practices, including the adoption of GPS-based tolling systems, penalties for faulty FASTag issuers, and timely toll plaza construction. Additional proposals emphasise toll revenue-sharing models, adherence to NH Fee Rules, and financial safeguards to enhance transparency. The reports also recommend prompt highway maintenance, addressing black spots, and providing user-friendly amenities like women-friendly facilities, Swachh Bharat toilets, and Highway Nest Mini services. A balanced approach leveraging technology and prioritising equity can help create a sustainable and inclusive tolling system for road infrastructure.

Sejal Gupta is a Senior Research Fellow at the Centre for Development Policy and Practice. Her areas of research include regulatory concerns around infrastructure, consumer, real estate sectors, and emerging technologies.

Anjana Divakar is a policy researcher and the Executive Director at the Centre for Development Policy and Practice that is based in Hyderabad.