Hyderabad: Gold rates in Hyderabad and other Indian cities have once again reached an all-time high, with the precious metal continuing to outperform stock market returns so far in January. Globally, too, it has continued the structural bull run into the start of 2026 on the back of enhanced safe-haven demand.

Returns from stock market

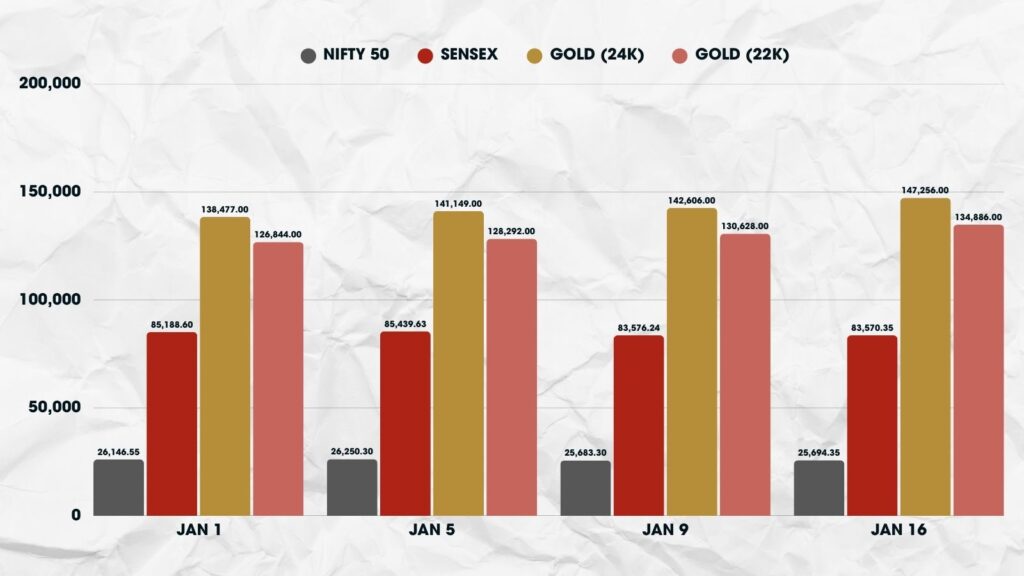

The benchmark indices of the stock market, NIFTY50 and Sensex, have given negative returns so far in January. While NIFTY50 fell by 1.73 per cent, Sensex dipped by 1.90 per cent in the current year so far.

NIFTY 50 declined from Rs 26,146.55 on January 1 to 25,694.35 on January 16. Sensex, too, dipped from Rs 85,188.60 to Rs 83,570.35 in the same period.

On the other hand, the gold rates in Hyderabad were Rs 1,38,477 and Rs 1,26,844 per 10 grams of 24-carat and 22-carat, respectively, on January 1. They have now jumped to Rs 1,47,256 and Rs 1,34,886 for 24-carat and 22-carat, respectively.

The yellow metal has surged by over 6 per cent in 16 days in 2026.

Safe-haven demand pushes gold, silver rates up in Hyderabad

Industrial demand, alongside renewed safe-haven buying, is pushing the prices of the yellow and white metals.

Investor sentiment in silver remains firmly constructive, supported by persistent supply deficits, record central bank buying and rising green-energy demand linked to solar, electric vehicles (EV) and artificial intelligence (AI) infrastructure.

According to analysts, recent pullbacks in precious metals were largely seen as healthy profit-taking rather than signs of trend fatigue, and the speed of subsequent rebounds has reinforced confidence in the longer-term uptrend.

According to them, the ongoing surge in gold and silver is being driven by structural demand rather than short-term speculative activity. Sustained central bank gold purchases, elevated geopolitical uncertainty and expectations of global monetary easing continue to reinforce gold’s role as a core portfolio hedge.

On the other hand, geopolitical uncertainty, persistent foreign fund outflows and concerns over further US tariffs on Indian exports are dampening stock market investors’ sentiment.