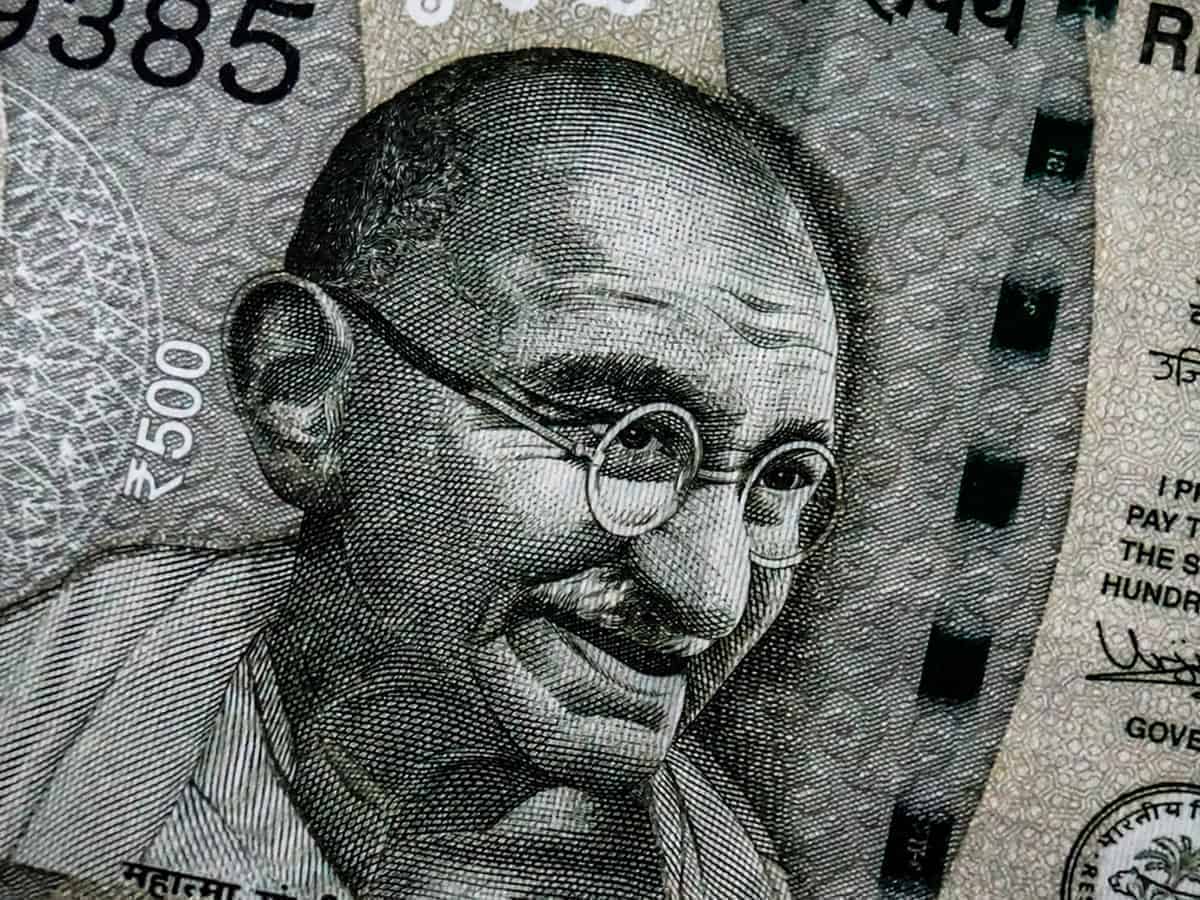

Mumbai: The rupee depreciated 35 paise to settle at an all-time low of 83.48 against the American currency on Friday, tracking a surging greenback against major crosses in the overseas markets and weak Asian peers.

Forex traders said foreign fund outflows also weighed on the local unit.

At the interbank foreign exchange market, the local unit opened weak at 83.28 against the greenback, and finally settled at a record low of 83.48 (provisional), registering a fall of 35 paise from the previous close of 83.13.

In intraday trade, the rupee touched a low of 83.52 against the American currency.

The rupee had earlier recorded its lowest closing level of 83.40 on December 13, 2023.

According to Anuj Choudhary, Research Analyst, Sharekhan by BNP Paribas, the US dollar strengthened on weak euro and pound.

Euro declined as the Swiss National Bank (SNB) surprised the markets by cutting interest rates by 25 bps to 1.5 per cent, which raised the odds of a rate cut by the European Central Bank (ECB) in June 2024.

The pound also fell after the Bank of England kept interest rates unchanged at 5.25 per cent. Two hawkish committee members, who voted for a rate hike in the previous meeting, also voted for a no rate hike. Robust economic data from the US also favoured the US dollar, Choudhary said.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading 0.31 per cent higher at 104.32 on Friday.

Brent crude futures, the global oil benchmark, declined 0.05 per cent to USD 85.74 per barrel.

“We expect the rupee to trade with a negative bias on the strong US dollar and expectations of a bounce back in crude oil prices. However, a positive tone in the domestic markets may support the rupee at lower levels. Any selling of dollars by the RBI may also support the rupee,” Choudhary added.

In the domestic equity market, the 30-share BSE Sensex settled 190.75 points or 0.26 per cent higher at 72,831.94. The broader NSE Nifty rose 84.80 points or 0.39 per cent to 22,096.75.

Foreign Institutional Investors (FIIs) were net sellers in the capital market on Thursday as they offloaded shares worth Rs 1,826.97 crore, according to exchange data.