New Delhi: The Congress on Thursday said the SEBI has asked for details of financial institutions owning certain foreign funds and asked whether the market regulator can enforce this now or it was another gesture to exonerate the Adani group.

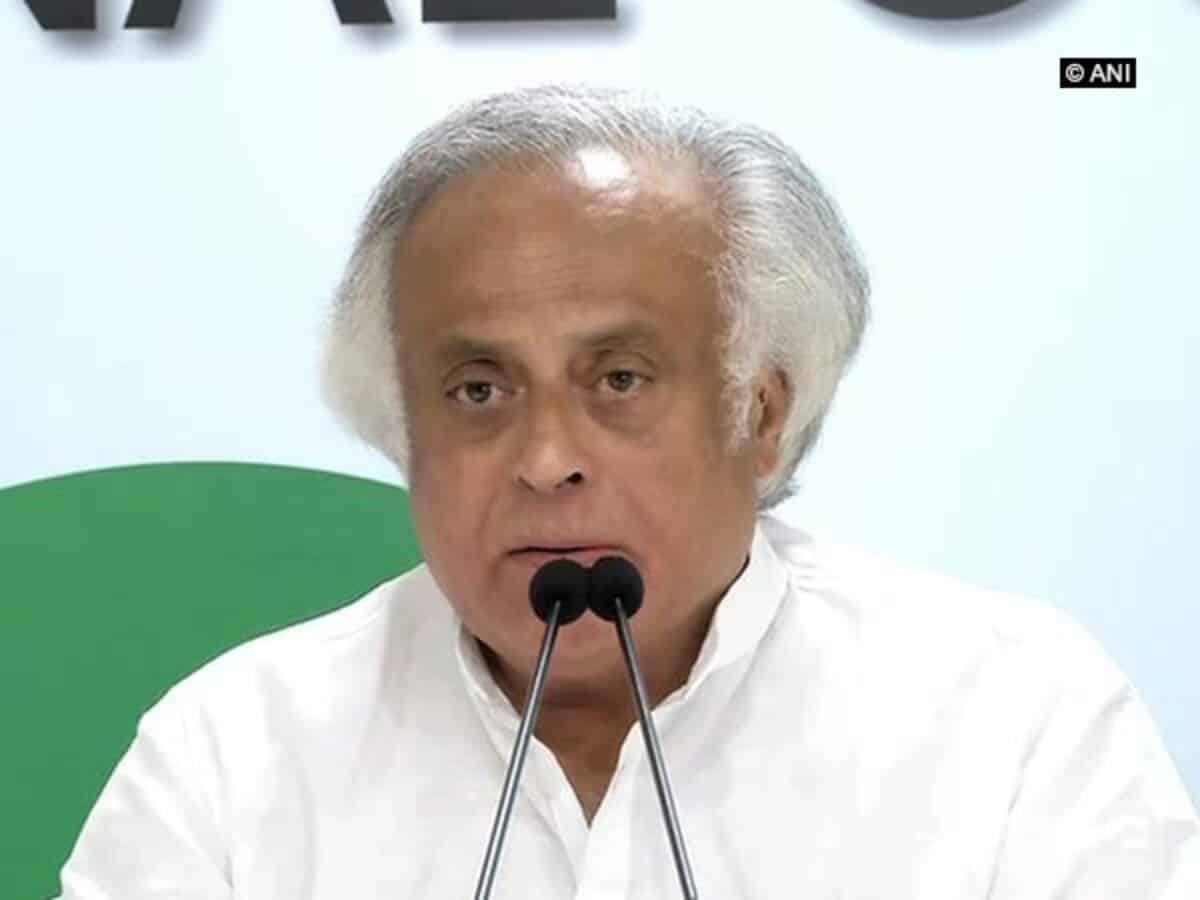

Congress general secretary communications Jairam Ramesh, quoting a media report, also asked on Twitter whether the move is a belated PR exercise to say “we tried but failed…” and how the SEBI would complete its investigation into the Adani issue before deadline fixed by the Supreme Court.

The apex court on Wednesday granted the Securities and Exchange Board of India (SEBI) time till August 14 to complete its investigation into the allegations of stock price manipulation by the Adani group and asked the market regulator to place on record an updated status report of the probe.

“Zara Chronology Samjhiye: First, SEBI suddenly loosens ownership regulations for Foreign Portfolio Investors so as to make them opaque. Then, the Adani Group takes full advantage of this opacity tailor-made for it by its Patron Minister. Then, the ‘Modani Saga’ gets unravelled. Congress and other parties hammer away at need for JPC. Modi government instead settles for Supreme Court expert committee,” Ramesh tweeted tagging the media report.

The Congress has been demanding a joint parliamentary committee (JPC) probe into the Adani issue.

“The SC expert committee holds SEBI accountable for making ownership regulations non-transparent. So, SEBI in response to Congress party’s persistence and expert committee’s finding gets into damage control mode, asking for detail of financial institutions behind certain funds,” he alleged.

The Congress leader asked, “Whether SEBI can enforce this now without getting entangled in court cases. Is it a belated PR exercise to say later — we tried but failed, what can we do?”.

“And if the information is required by September, how is it expected to arrive before the Supreme Court’s August 14 deadline to SEBI? Or is this is yet another token gesture at the end of which Modani gets exonerated and legitimised,” Ramesh asked.

The Congress has been alleging that the Adani group has indulged in “financial malpractices” as reported by US-based short seller Hindenburg Research. The short-seller had made a litany of allegations, including fraudulent transactions and share-price manipulation, which led to stock crash of Adani group shares.

The Adani group has, however, denied all the allegations and said there has been no wrongdoing on its part.

The Congress had earlier come out with a set of 100 questions on the Adani issue and had sought answers from the prime minister, asking him to break his silence on the matter.