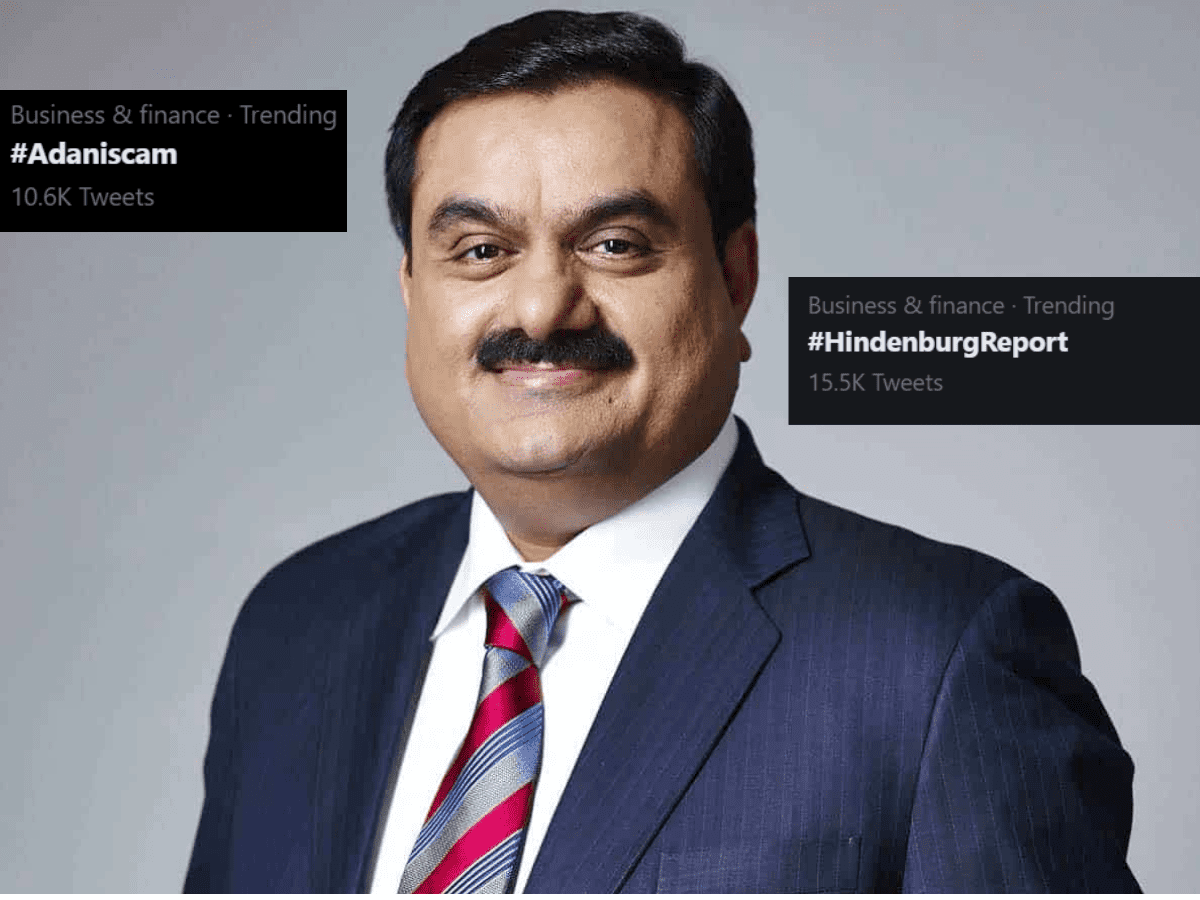

Following the outbreak of the Hindenburg report on the Adani group, on Friday, the hashtags ‘Hindenburg Report’, ‘Hindenburg Research’, and ‘Adani scam’ trended on Twitter.

Several Twitter users including members of the opposition raised questions on the union government’s role in the development.

Along with the Adani Group share pummelling on Friday, with the group losing Rs 3.37 lakh crore in aggregate market capitalisation in a single day, Life Insurance Corporation (LIC), the single largest non-promoter domestic shareholder in five of the largest Adani Group companies by market capitalisation, lost Rs 16,627 crore due to a drop in the value of its Adani Group holdings.

The value of LIC’s Adani Group assets fell from Rs 72,193 crore on Tuesday to Rs 55,565 crore on Friday, a 22% drop in only two days.

Meanwhile, LIC’s share price declined 3.5 percent during the day on Friday, falling 5.3 percent in the prior two days.

By the time of publishing this story, #Adaniscam garnered 10.4k tweets and #HindenburgResearch garnered 4764 tweets.

Reactions

Some of India’s top public sector banks stated their exposure to the Adani Group was within the limitations outlined by the Reserve Bank of India despite Friday’s steep decline in shares of group firms and the lenders that have exposure to it. The RBI permits a bank to expose no more than 25 percent of its eligible available capital base to any one group of related entities.

“There is nothing alarming about our Adani exposure and we don’t have any concerns as of now,” SBI chairman Dinesh Kumar Khara said speaking to Reuters.

Khara said the Adani Group hadn’t raised any funding from SBI in the recent past and that the bank would take a ‘prudent call’ on any funding request from them in the near future, reported Reuters.

SBI has reached out to the company for clarification and the board will take any decision on the bank’s exposure to the group only after that, reported Reuters quoting an unnamed official.

An official at the state-run Bank of India said the loans to the Adani group were within permissible limits.

“Our exposure to the Adani Group is below the large exposure framework of the Reserve Bank of India,” Reuters quoted an unnamed executive at the Bank of India as saying.

“Till last month, the Adani Group’s interest payment on loans has been intact.”

Bank executives at two other private lenders said that they were not yet in “panic mode” but being watchful, the report stated.

The LIC is still investing additional money in Adani’s flagship unit despite the fraud allegations. According to a document, the state-controlled life insurer is investing around $37 million as an anchor investor in Adani Enterprises Ltd.’s $2.5 billion new share sale. It would increase its present ownership of 4.23% with the investment.

Adani Power Ltd., Adani Green Energy Ltd., Adani Transmission Ltd., Adani Ports, and Special Economic Zone Ltd., and Adani Enterprises Ltd. make up the Adani Group.

What is the Hindenburg report?

Hindenburg Research, a well-known short seller in the United States, disclosed short positions in the Adani Group on Wednesday, accusing the conglomerate of the improperly wide use of businesses established in offshore tax havens and expressing worry about excessive debt levels.

The revelation, which came just days before Adani Enterprises’ (ADEL.NS) $2.5 billion share sale, sent Adani group businesses’ shares tumbling.

It also said that seven Adani listed firms had an 85% downside on a fundamental basis because to what it dubbed ‘sky-high valuations’.

The firm published an investigative document titled ‘Adani Group: How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History‘ and revealed findings of their two-year investigation presenting evidence that the Rs 17.8 trillion worth Adani group has engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades.

According to the report, Gautam Adani, the Adani Group’s founder, and chairman, has a net worth of about $120 billion, which he has increased by more than $100 billion in the last three years, primarily as a result of stock price growth in the group’s seven most important publicly traded companies, which have increased by an average of 819 percent during that time.

KT Rama Rao had also challenged the central investigative agencies including the Enforcement Directorate (ED), Central Bureau of Investigation (CBI), Income Tax Department (IT) and Securities and Exchange Board of India (SEBI) to probe into the Adani enterprise’s ‘scam’.

The challenge comes hours after US’s Hindenburg Research’s investigative document, alleging fraud in Adani Group’s dealings, surfaced.

The Adani Group has said that accounting (or fraud-type assertions) “investigation” by Hindenburg Research are devoid of facts.

Of Adani’s portfolio’s nine publicly listed entities, eight are audited by one of the Big 6.

On leverage or over-leverage issue — 100 of our various companies are rated (these account for nearly 100 percent of our EBITDA), Adani Enterprises said in a stock exchange filing.

On revenue or balance sheet being artificially inflated or managed — out of nine listed companies in Adani portfolio six are subject to specific sector regulatory review for revenue, costs, and capex, Adani Group said.

In relation to governance, four of our large companies are in the top 7 percent of the peer group in Emerging markets or the sector of the world.

On the LAS position do note that overall promoter leverage is less than 4 percent of promoter holding, the group said.

Hindenburg asked 89 questions in total, the following Question by number: 1,2,3 5,6,7 19,20,21, 27,28,29 62,63,64 and 72,74,75,77,78,79 are in relation to Related party transactions, DRI (Directorate of Revenue Intelligence) and court cases.

Twenty-one in total cannot be claimed to be the result of any investigation over a two-year period or any such assertion as they were disclosed in the public documents all the way back from 2015 onwards, the group said.

The 21 questions are nothing but Adani Portfolio’s own public disclosure from as far back as 2015, the statement said.