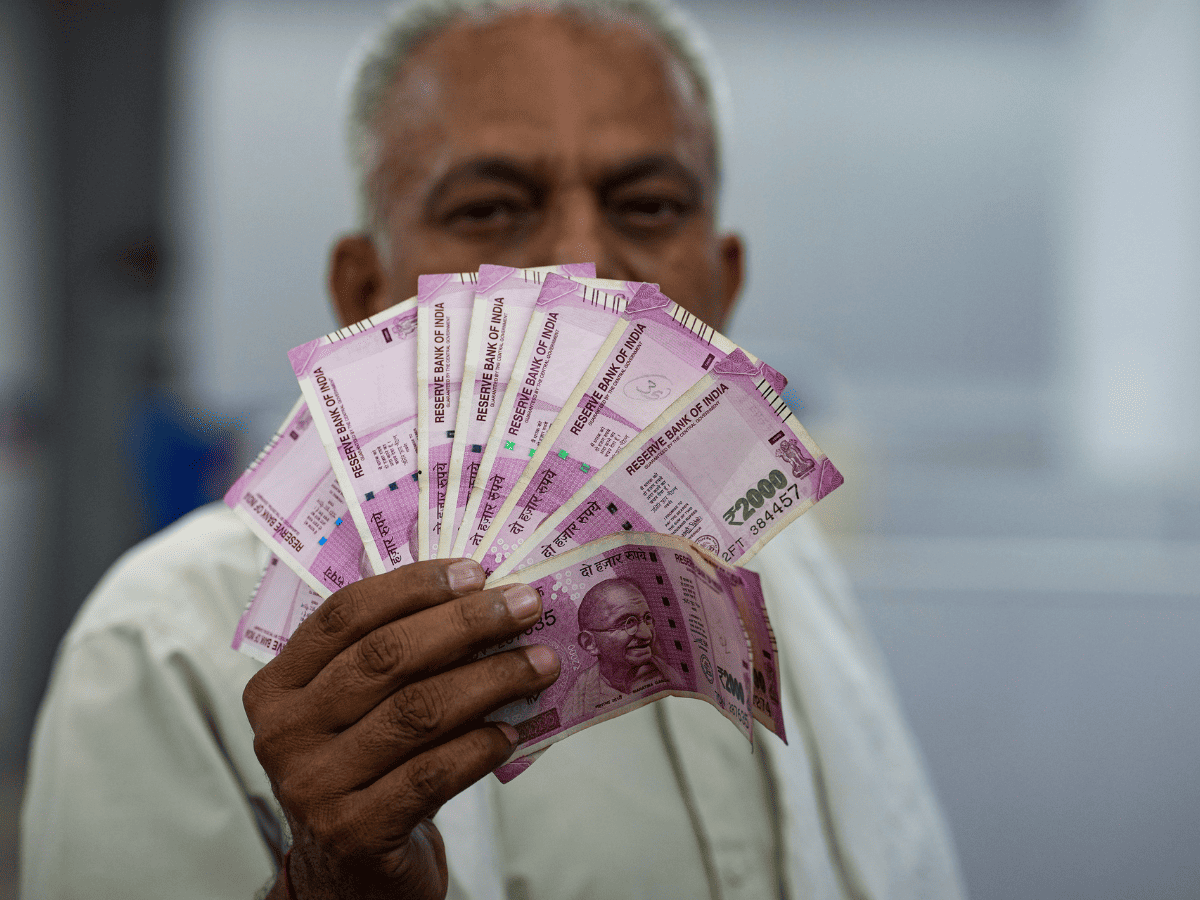

New Delhi: Small queues were witnessed at some bank branches on Tuesday for the exchange of Rs 2000 notes against smaller denominations as part of the withdrawal exercise.

As per the RBI guidelines issued on Friday, the exchange of Rs 2000 facility is available from Tuesday.

A person can exchange up to a limit of Rs 20,000 at a time without filling out any form or requisition slip.

Further, no identity proof is required to be submitted by the tenderer at the time of exchange.

No great rush was witnessed for exchange when branches opened. Outlets of private sector banks in metro cities in the early hours had business as usual.

According to a senior official of a public sector bank, not much rush is seen so far because there is a window of four months for exchange and currency in circulation to be exchanged is also relatively less compared to demonetisation.

It is to be noted that 86 per cent of India’s currency in circulation was made invalid on November 8, 2016.

However, this time, Rs 2000 notes remain legal tender.

The official said, as far as the deposit in accounts are concerned, it is happening as usual and there is not much rush so far. Deposits are being accepted as per the extant guidelines.

Unlike the November 2016 shock demonetisation, when old Rs 500 and Rs 1000 notes were invalidated overnight, the Rs 2000 notes will continue to be legal tender.

RBI Governor Shaktiikanta Das on Monday said there is enough time available for exchange and deposit in bank accounts, so people should not panic.

There is more than adequate quantity of printed notes available in the system not just with the RBI, but also at the currency chests which are operated by the banks, he said.

“So there is adequate stock available and there is no reason to worry whatsoever. We have more than sufficient stock,” he said.

The governor also said that the RBI is sensitive to the difficulties which may be faced by people who are on long foreign visits or living abroad on work visas.

“It will be our endeavour to address the difficulties of the people and to complete the entire process in a smooth manner,” he said.

To a question regarding black money coming back to the system, he said, there is a set procedure for deposits in your account or cash exchange.

“What we have said is that the existing requirements or the existing procedures have to be followed by the banks. We have not come out with an additional procedure. You must be aware that there’s an Income Tax rule if you deposit cash above Rs 50,000 then you have to produce your PAN. So existing rules will apply,” he said.

Statutory exercise: RBI to Delhi HC

On Tuesday, RBI told the Delhi High Court that the withdrawal of Rs 2000 notes is not demonetisation but a statutory exercise, and the decision to enable their exchange was taken for operational convenience.

The court was hearing a plea by lawyer Ashwini Kumar Upadhyay that the notifications by the RBI and SBI enabling the exchange of Rs 2000 banknotes without proof were arbitrary and against the laws enacted to curb corruption.

A bench of Chief Justice Satish Chandra Sharma and Justice Subramonium Prasad said it will an pass appropriate order on the public interest litigation by the lawyer.

“We will look into it. We will pass an appropriate order,” said the court.

Upadhyay clarified that he was not challenging the decision to withdraw Rs 2000 banknote but assailed the exchange of the currency without any slip or identity proof.

He asserted that the exchange of Rs 2000 banknote should be allowed through a deposit in a bank account.

“Why is ID proof excluded? Every poor has a Jan Dhan account. BPL (Below Poverty Line) persons are also connected to bank accounts,” Upadhyay said while claiming that the present arrangement would only enable mafias and gangsters like “Atiq Ahmed’s henchmen” as well as Naxals.

Senior advocate Parag P Tripathi, for the RBI, emphasised that the court cannot interfere in such matters and the decision was taken to allow the exchange of the Rs 2000 currency note for operational convenience.

“This is not demonetisation but a statutory exercise. Rs 2000 banknote was not commonly used. Other denominations continue to meet currency requirements,” he said.

The petitioner has contended in his plea that notifications by the RBI and SBI enabling the exchange of Rs 2000 banknotes without requisition slip and identity proof were arbitrary, irrational and offends Articles 14 of the Constitution of India.

The petition has said that a large amount of the currency has reached either an individual’s locker or has “been hoarded by the separatists, terrorists, Maoists, drug smugglers, mining mafias & corrupt people”.

The petition has highlighted that cash transaction in high-value currency is the main source of corruption and is used for illegal activities like terrorism, naxalism, separatism, radicalism, gambling, smuggling, money laundering, kidnapping, extortion, bribing and dowry, etc. and the RBI and SBI should ensure that Rs 2000 banknotes are deposited in respective bank accounts only.

On May 19, RBI announced the withdrawal of Rs 2,000 currency notes from circulation and said existing notes can either be deposited in bank accounts or exchanged by September 30.

The banknotes in Rs 2,000 denomination will continue to be a legal tender, the RBI said in a statement.

In order to ensure operational convenience and to avoid disruption of regular activities of bank branches, the RBI has said the exchange of Rs 2,000 bank notes into banknotes of other denominations can be made up to a limit of Rs 20,000 at a time at any bank starting from May 23.