The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) today retained the repo rate at 6.5 percent. The historical trend of the repo rate in India shows that it reached as high as 9 percent on July 30, 2008.

The term “repo rate” is short for “repurchase option rate,” and it represents the rate at which the RBI lends to commercial banks against the collateral of securities.

How does repo rate impact Indian economy?

Several factors in the Indian economy, including inflation, currency exchange rates, deposit rates, and lending rates, are linked to the repo rate.

The primary responsibility of the RBI is to maintain inflation at 4 percent with a margin of two percent on either side. Controlling the level of money supply in the market is crucial for managing inflation, as it is directly proportional to the money supply.

The repo rate is a key instrument for the RBI to control the money supply. If the RBI aims to increase the availability of money in the market, it lowers the repo rate. Conversely, if the central bank decides to decrease the money supply, it raises the repo rate.

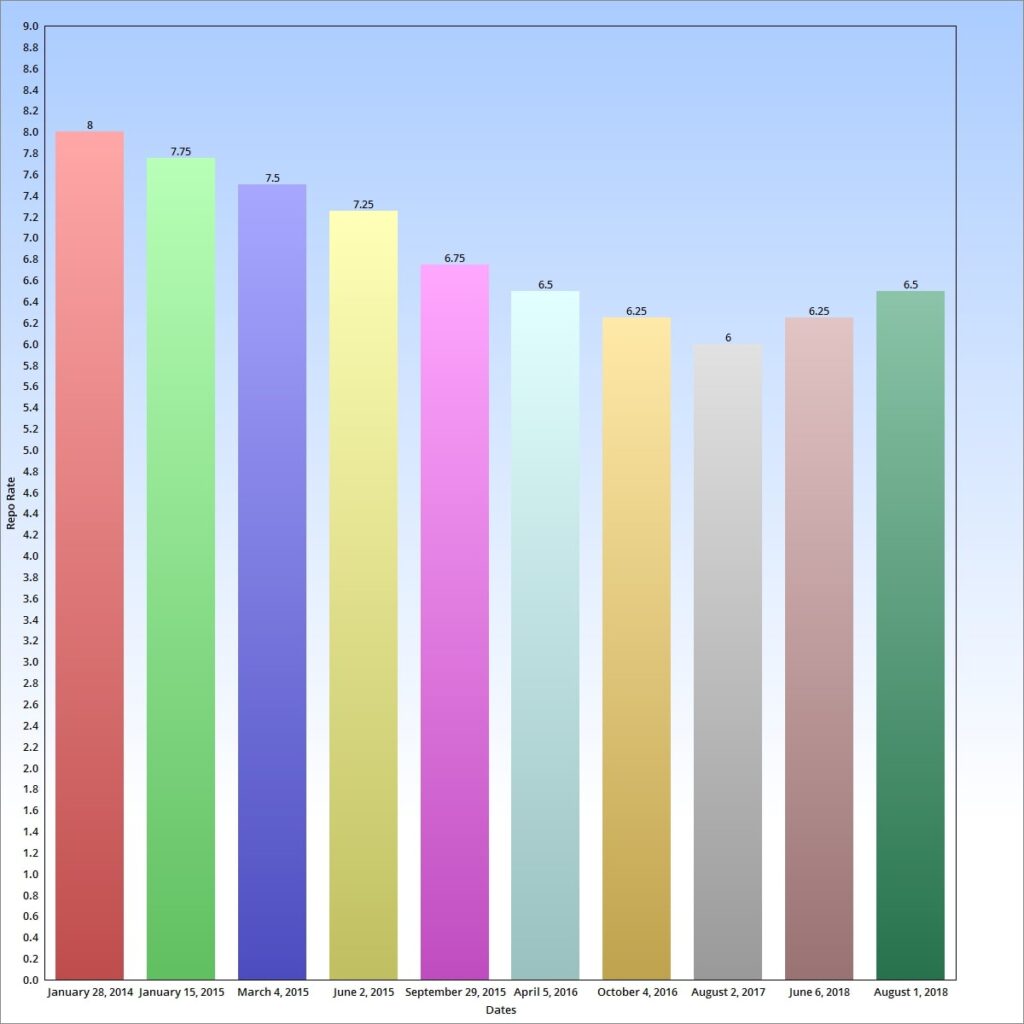

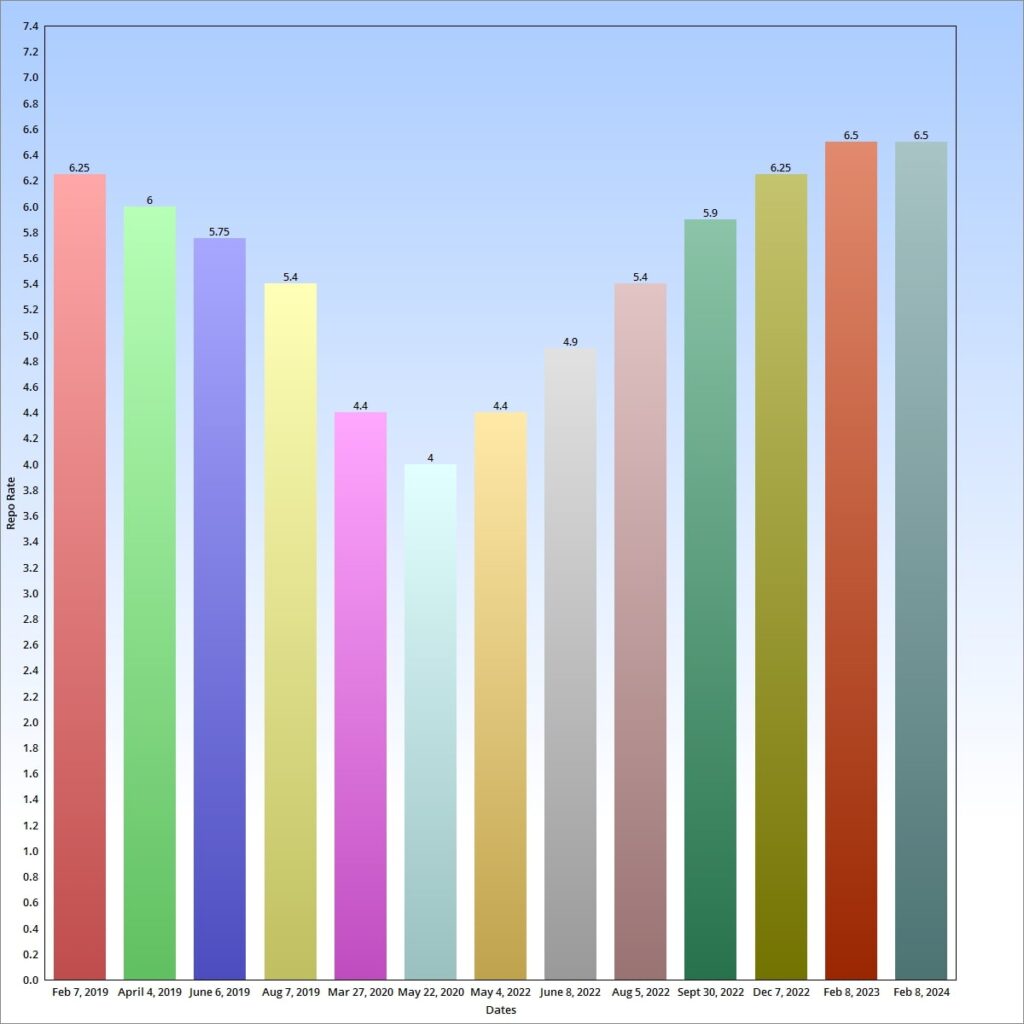

The historical trend of the repo rate in India also shows that RBI used the tool to increase and decrease the money supply in the country.

Impact of repo rate on loan and deposit rates

Besides its impact on inflation, the repo rate affects loan and deposit rates, as commercial banks borrow money from the RBI.

If the repo rate rises, commercial banks’ borrowing becomes more expensive, leading them to lend money to the public at higher rates. Simultaneously, this might result in an increase in deposit rates.

Due to a rise in the repo rate, businesses may struggle as a decrease in money supply lowers demand, impacting the employment rate. Although an increase in the repo rate affects overall growth, it is essential for the RBI to maintain inflation.

Historical trend of repo rate in India

Over the past decade, the repo rate reached as high as 8 percent on January 28, 2014, and as low as 4 percent on May 22, 2020.

Today, the RBI retained the repo rate at 6.5 percent; however, there is a likelihood of a decrease in the next MPC meeting.