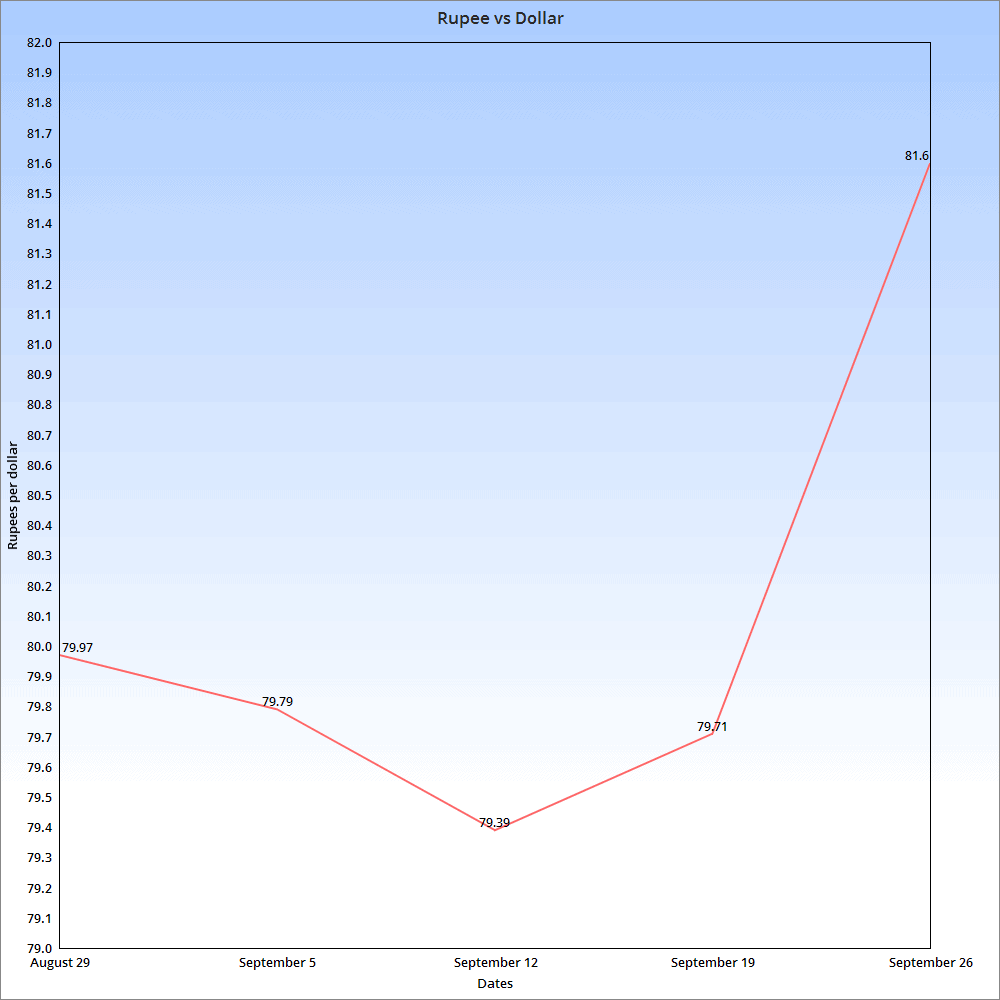

Mumbai: The Indian rupee fell to a new record low against the US dollar on Monday. At the interbank foreign exchange market, the rupee was trading at 81.60 against the US dollar.

Although the Reserve Bank of India (RBI) has been intervening to control the fall in the Indian rupee against the US dollar, the exchange rate registered a new record low today.

One of the major factors behind the fall in the exchange rate is the hawkish fed outlook. Over the past few months, the fed is increasing interest rates to control inflation.

The two-year US Treasury yield was at 4.2 percent, its highest level since October 12, 2007.

How it will impact common people

Rise in inflation

As 80 percent of India’s energy demand is met by importing fuel. The payment for the fuel is done in dollars. In these circumstances, if the rupee falls against dollars, its purchasing power will decline thereby leading to rise in fuel prices in India.

As the prices of most of the commodities are affected by the rise in fuel prices, it may lead to inflation in the local market.

Loan interest rate

If inflation rises, RBI has to step in and control it by increasing the repo rate.

As the repo rate is one of the deciding factors for loan rates, banks will start raising the interest rates thereby making the loans costly.

Impact on stock market

The decline in the rupee rate will have a huge impact on the stock market too.

Investors who like to invest in a market that can give them maximum returns will pull the amount from the market thereby creating instability in the market.

Most of the FPI investors will be the first to pull out their investments which will result in a further decline in rupee value.

Study abroad

Those who are planning to study in the US will have to get ready to pay more for their education.

As universities accept course fees in dollars, a fall in the rupee means students will have to pay more than earlier.

Overall, the fall in the rupee against the US dollar will not only impact the purchasing power of common people but also impact India’s economy.