Tax

- Business

Market participants seek equity tax relief ahead of Budget

New Delhi: Market participants have urged the government to ease capital market taxation, including a higher exemption limit on long-term capital gains, ahead of the Union Budget for 2026-27. They also suggested…

- Business

Experts warn tobacco tax hike may boost smuggling, hit revenue

New Delhi: An unprecedented tax hike, coupled with a new excise duty structure on tobacco, could lead to a surge in illicit trade of cigarettes and result in significant tax revenue losses…

- Middle East

Saudi Arabia to roll out four-tier sugar tax on drinks from Jan 1

Riyadh: Saudi Arabia’s Zakat, Tax and Customs Authority (ZATCA) has approved amendments to the executive regulations of the excise tax, introducing a sugar-content-based levy on sweetened beverages from January 1, 2026. The…

- India

No GST return filing allowed for dues pending over 3 yrs: GSTN

New Delhi: Businesses will not be able to file GST returns which are due for three years or more beginning the November tax period, GST Network (GSTN) has said. In an advisory,…

- Middle East

UAE set to apply new sugar drink excise tax from January 2026

Abu Dhabi: The United Arab Emirates (UAE) will introduce a new tiered excise tax on sugar-sweetened beverages from January 1, 2026, following the completion of legislative amendments by the Ministry of Finance.…

- India

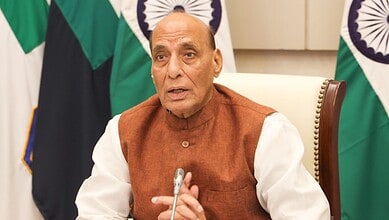

Jains contribute 24 pc of tax revenues: Rajnath Singh

Hyderabad: Defence Minister Rajnath Singh on Friday said that although the Jain community constitutes just 0.5 per cent of India’s total population, their tax contributions account for 24 per cent of total…

- India

Patanjali foods lowers MRPs on Food, Non-Food products post GST cut

New Delhi: Patanjali Foods Ltd has reduced retail prices (MRP) of various products, including Nutrela soya chunks, with effect from Monday, passing on the benefits of GST reduction to consumers. In a…

- Business

Sitharaman to attend GoM meeting on Aug 20, explain next-gen GST reforms

New Delhi: Finance Minister Nirmala Sitharaman will attend a crucial meeting of a state ministerial panel on August 20 to put forth the Centre’s proposal for sweeping GST reforms that will slash…

- News

‘Next Gen GST’ precursor to eventual single tax slab GST: Sources

New Delhi: Describing the proposed GST tax reforms as ‘Next Gen GST’, senior government officials on Saturday said that the two-slab tax regime will eventually pave the way for a single sales/services…

- Business

New I-T Bill: No ITR filing exemptions for small taxpayers

New Delhi: The new Income Tax Bill, 2025, passed by the Lok Sabha, clarifies that late-return filers are eligible for refunds on excess taxes deducted in a financial year. Analysts said on…

- India

Govt makes tax compliance easier for content creators, influencers

New Delhi: This tax season marks a significant change in the filing of returns for social media content creators and influencers, with their income now being classified under a specific category. The…

- Middle East

UAE to roll out sugar-based tax on sweetened drinks

Abu Dhabi: The United Arab Emirates (UAE) will implement a new sugar-content-based excise tax on sweetened beverages starting January 2026, the Ministry of Finance and the Federal Tax Authority (FTA) announced on…

- Business

Time taken for tax refunds in India cut from 3 months to 17 days in last 11 years

New Delhi: The average number of days it takes for taxpayers to get refunds from the Income Tax Department in India has come down drastically from 93 days in 2013 to a…

- Business

GST Council meeting soon, tax slab rates & compensation cess key review points

New Delhi: The Goods and Services Tax (GST) Council is expected to meet soon to review the tax regime. This could be the most significant review since the scheme was announced on…

- India

LoP Gandhi slams GST, demands people-centric tax reforms

New Delhi: Leader of the Opposition (LoP) in the Lok Sabha, Rahul Gandhi on Tuesday launched a sharp attack on the Goods and Services Tax (GST) regime, describing it as a “tool…