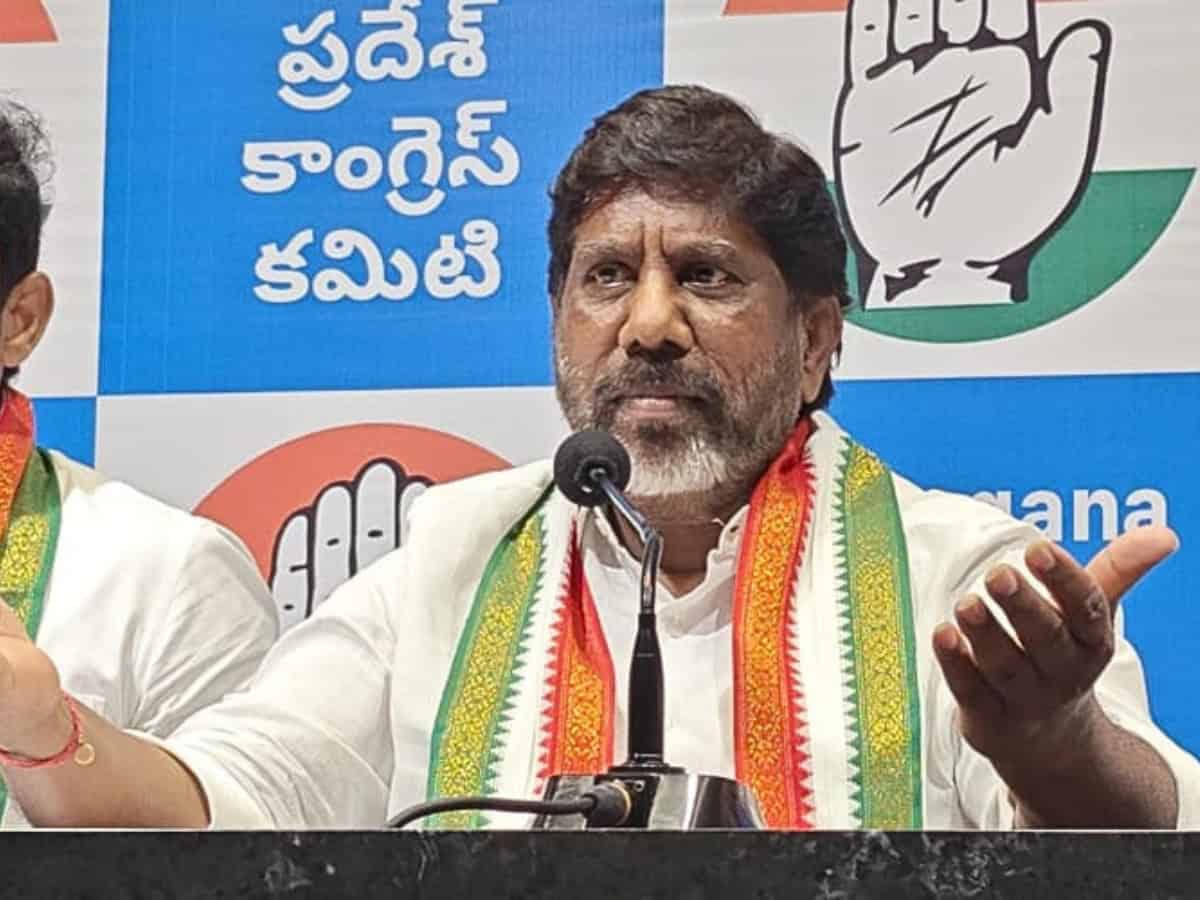

Hyderabad: Deputy chief minister and Finance minister Mallu Bhatti Vikramarka has proposed a reduction in the Goods and Services Tax (GST) rate on health insurance premiums from 18% to 5% for all age groups.

He made this suggestion during the GST Council meeting held in New Delhi, which was chaired by Union Finance Minister Nirmala Sitharaman. Accompanying him was SAM Rizvi, the Principal Secretary of the Revenue Department.

Vikramarka emphasized the necessity of lowering or exempting health insurance premiums, particularly for senior citizens, citing the high medical expenses that burden middle and lower-middle-class families.

He argued that it is the responsibility of the government to ensure that quality healthcare is accessible and affordable for everyone, thereby making health insurance more attainable for all citizens.

During the meeting, Vikramarka put forward several proposals, including the exemption of GST on research grants or donations received from both government and private entities.

Additionally, he recommended forming a Group of Ministers (GoM) to investigate this issue and propose a future course of action.

Vikramarka expressed his willingness to participate in the GoM.

On compensation cess

He also addressed the matter of the compensation cess, suggesting that once the loan amount is settled, it would be fitting to incorporate the cess into the State Goods Regarding the recovery of excess ad hoc IGST apportionment, the deputy chief minister informed the Council that Telangana initially received an ad hoc apportionment of 4.02% of the total amount based on revenues from the fiscal year 2015-16.

However, it is now proposed to recover this at a rate of 5.07% using a different formula. Consequently, he recommended establishing a Committee of Officers (CoO) to investigate the situation and develop a comprehensive formula for state recoveries.

The Council agreed to refer this issue to a CoO, instructing them to deliver a report within one month for discussion and decision-making in the upcoming GST Council meeting and Services Tax (SGST) component, as the compensation cess was intended to bolster state finances.