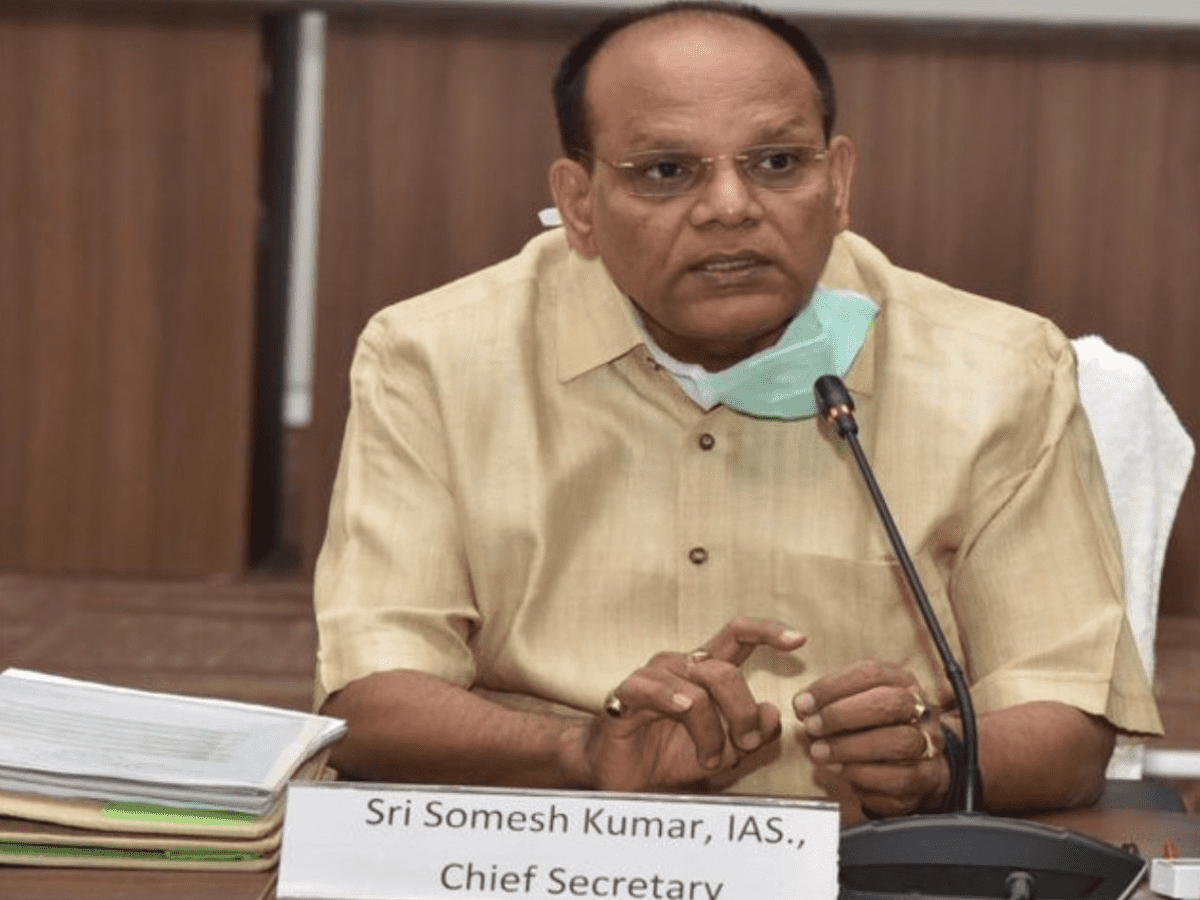

Hyderabad: The Central Crime Station (CCS) of the Hyderabad police has registered a case against former chief secretary Somesh Kumar and two senior officers of the Commercial Taxes department for alleged Goods and Services Tax (GST) violations. Kumar was heading the department during the previous Bharat Rashtra Samithi (BRS) government headed by ex-chief minister K Chandrashekar Rao (KCR).

The case was booked on a complaint lodged by the Joint Commissioner (CT), Central Computer Wing, Nampally, Hyderabad, K Ravi Kanuri, on July 26. The FIR also names Plianto Technologies Private Limited and IIT-Hyderabad assistant professor Sobhan Kumar for the alleged GST violations.

During a verification, Commercial Tax Department officials reportedly found 11 cases that were allegedly masked by IIT-Hyderabad. During the inquiry, evasion of over Rs 1,000 crore was reportedly unearthed through fraudulent cases detected in Telangana. The allegations against Somesh Kumar and others include masking of data pertaining to taxpayers, issuing instructions not to cancel fraudulent cases etc.

“It was noticed that GST fraud was committed in the case of Big Leap Technologies and Solutions Private Limited. The entity, dealing in manpower supplies, has passed on input tax credit worth Rs 25.5 crore without actually paying any tax to the govt, leading to loss to the state exchequer,” Ravi Kunuri stated in his complaint.

The Commercial Taxes department had earlier engaged IIT-Hyderabad as a service provider for development of software by the commercial taxes department. The role of the service provider was to perform analytics and generate discrepancy reports based on returns filed by taxpayers registered in Telangana.

“Discrepancy was figured in desk audit of Big Leap Technologies and Solutions Private Limited. However, it did not appear in reports generated through the ‘scrutiny module’ developed by IIT-Hyderabad. In order to enquire into the facts, an officer from the department was authorised to visit IIT-Hyderabad. Several lacunae were identified, including non-documentation of changes made to the software, changes in applications being done on oral instructions from the then special chief secretary, revenue (CT), additional commissioner (ST), (IT & EIU), SV Kasi Visweswara Rao, and deputy commissioner (ST), STU-1, Hyderabad Rural, Siva Rama Prasad, etc,” read the complaint.

The officer from the Commercial Taxes department officials also stated that it was also reported that the scrutiny reports developed did not capture IGST discrepancies, leading to loss of revenue. After the discrepancies came to light, an explanation was sought from SV Kasi Visweswara Rao, Siva Rama Prasad and Plianto Technologies Private Limited.

“The statements given by some of them revealed that the authority was drawn from the instructions issued by the then special chief secretary Somesh Kumar. They also stated that they gave a format to IIT-Hyderabad for capturing all four discrepancies i.e., IGST, CGST, SGST and Cess, and they were not aware as to why IGST and Cess notices were not generated,” the complaint stated.

Plianto Technologies Private Limited denied developing any software for the commercial taxes department. State audit department and C-DAC did a comprehensive audit of applications and databases hosted at IIT- Hyderabad. During the course of the meeting, it was revealed that project investigator, prof Sobhan Babu, took instructions through a WhatsApp group, ‘Special Initiatives’, with Somesh Kumar, SV Kasi Visweswara Rao, A Siva Rama Prasad and the academic as its members.

Changes were made to the software based on the directions issued in the WhatsApp group. “On verification of the WhatsApp chat history, it was noticed that certain reports were generated estimating IGST loss and instructions were issued not to cancel registrations even in fraud cases,” the complainant added

The police invoked Section 406, 409 , 120 B of IPC and Sections of IT Act.