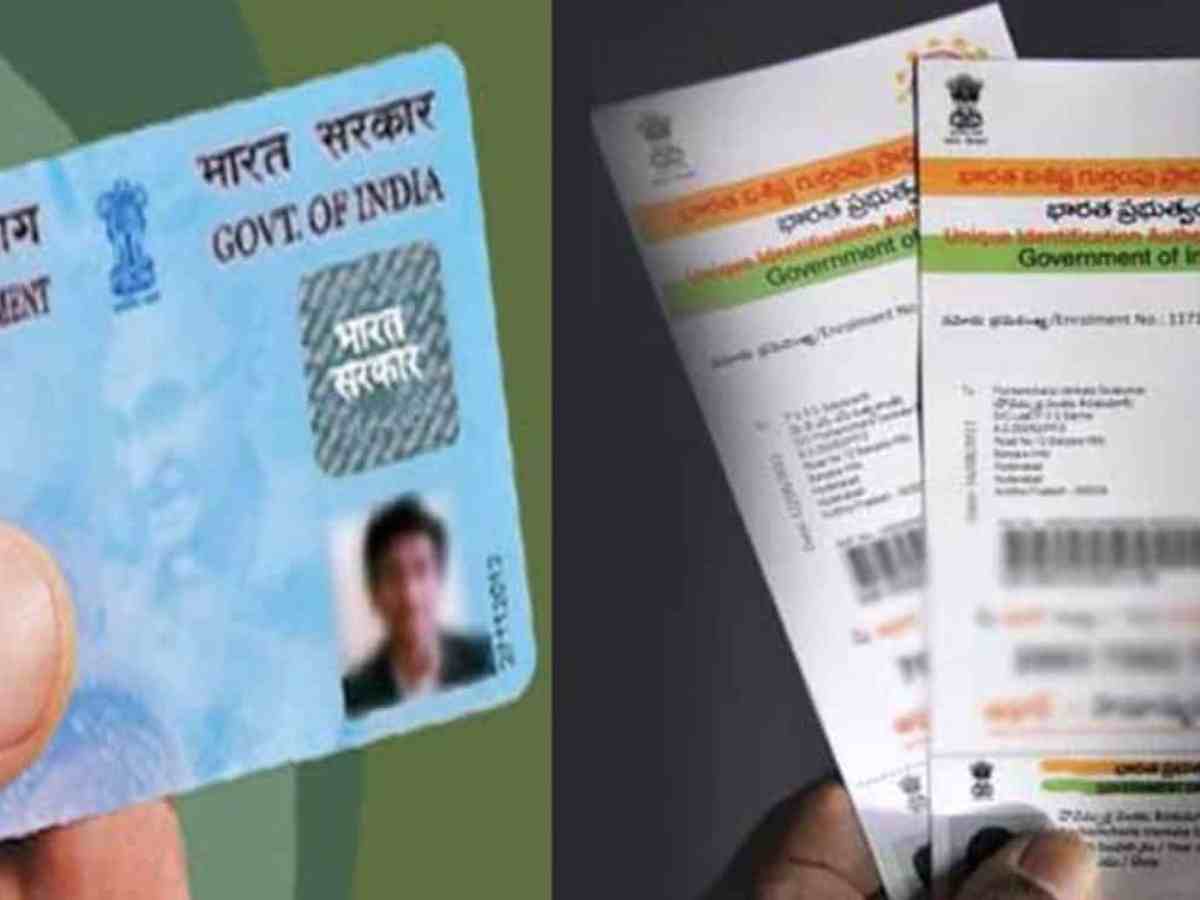

The last date to link PAN (Permanent Account Number) with Aadhaar is today. Initially set for March 31, the deadline was extended until June 30 by the Income Tax Department. Failure to link PAN and Aadhaar by today may lead to consequences.

The primary goal of linking PAN with Aadhaar is to eliminate duplicate entries in the PAN database. The Income Tax Department discovered instances where individuals were assigned multiple PAN numbers.

Consequences of not linking PAN with Aadhaar

If PAN and Aadhaar are not linked by the last date i.e., June 30, the individual’s PAN will become inoperable. This means they will be unable to file income tax returns and encounter difficulties in conducting financial transactions at banks.

Investors in the securities market must also link their PAN and Aadhaar to avoid any transactional obstacles.

Procedure to link

Following is the procedure to link PAN and Aadhaar online.

- Visit the official website of the Income Tax Department (click here).

- Locate the PAN-Aadhaar linking section on the website.

- Enter the required details, including PAN and Aadhaar information.

- Follow the instructions and complete the linking process.

- This online procedure is not only simple but also fast, taking only a few minutes to complete.