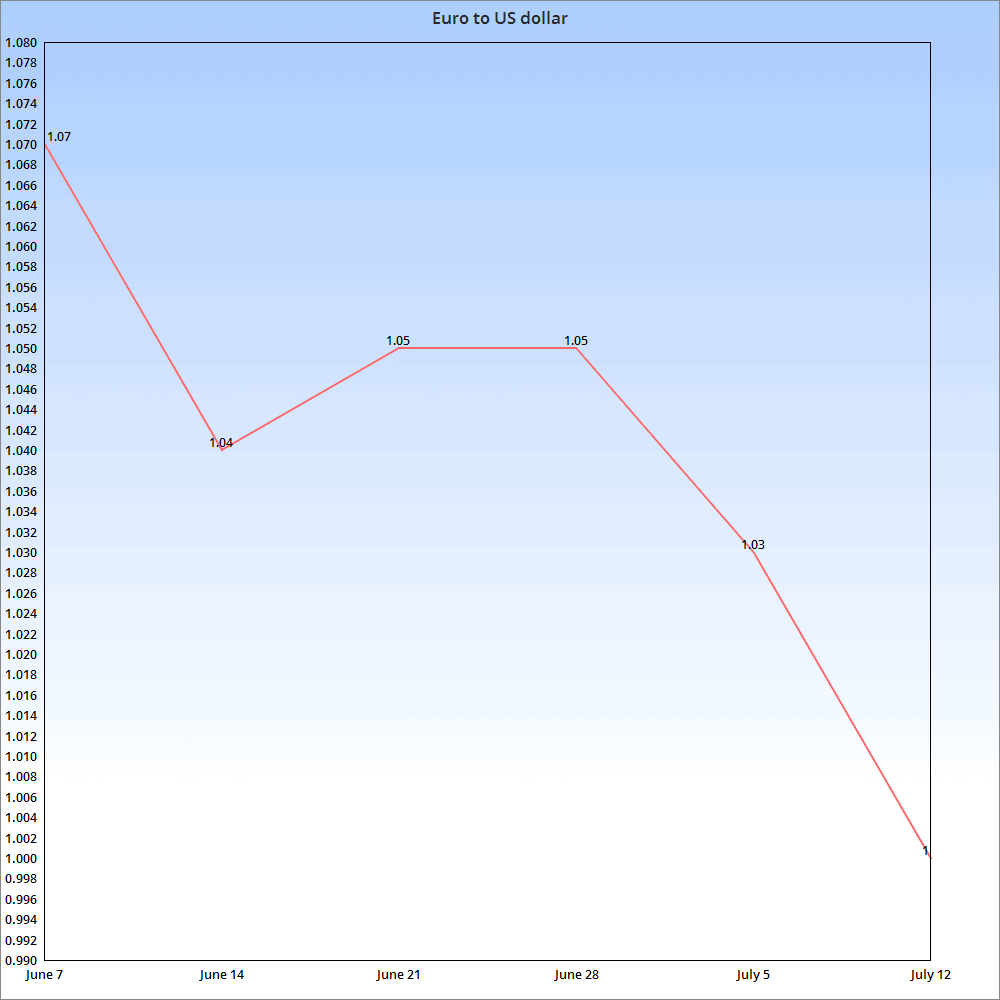

London: The exchange rate between the Euro, the official currency of 19 European Union member countries, and the US dollar became equal on Tuesday for the first time in 20 years.

The euro dipped to the current level due to the rising risk of recession in the region. It has fallen down to one dollar per euro. It is the lowest level since December 2002.

Is Europe at risk of recession?

Europe is facing a risk of recession due to the rising oil and gas prices amid the ongoing war in Ukraine. The fall in demand in the US is another threat to the economy in Europe.

In June, the inflation in the eurozone hit an annual rate of 8.6 percent which is the highest since the bloc was created in 1999.

Experts believe that the recession will continue in Europe till the summer of 2023.

Why are energy prices rising?

The energy prices which had gone down after the outbreak of COVID-19 started climbing after the lifting of pandemic restrictions.

Russia’s invasion of Ukraine has led to a further surge in fuel prices as the EU, the US, and the UK have sought to isolate Russia economically.

There is also a threat that Russia could cut the output to retaliate against efforts to cap prices by the G7 group of large economies.

If Russia takes the decision to cut the output, it is expected that the price of per barrel oil may be tripled. Currently, the oil price per barrel is $104.99.