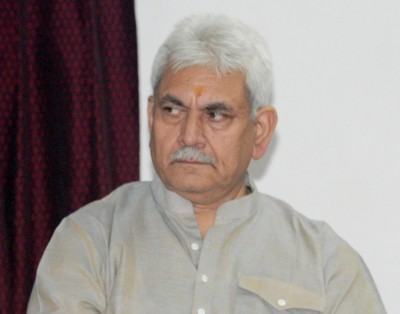

Jammu: Jammu and Kashmir Lieutenant Governor Manoj Sinha on Tuesday reviewed the progress made in financial inclusion by banks in J&K with M.K. Jain, Deputy Governor of RBI, Arun Kumar Mehta, Chief Secretary, and other officials.

Sinha shared the vision of the UT government for extending banking and financial services at the doorsteps of the people of J&K.

Efforts are being made to enable far-flung areas of rural interiors to become fully connected with the financial sector, he said.

“To broaden the social base of development, we are enhancing people’s access to financial products, promoting ‘One District One Product’, institutional credit to women, youth, SMEs, handicrafts, horticulture and various other priority sectors for effective contribution to the growth processes of the UT,” Sinha said.

“J&K has become one of the preferred destinations for industrial investment, tourism, film industry and real estate sector. The government is committed to ensure adequate and timely availability of credit to industrial and different productive sectors of the economy to finance growth,” he added.

In the last two years, various reforms have been executed to provide opportunities to scheduled commercial banks to expand operations in J&K, he said.

“We will also work together to make our credit lending system more sensitive to the needs of women and youth entrepreneurs, farmers and artisans,” Sinha said.

There is a need for additional banking outlets in the rural areas to bring excluded households into the fold of institutional credit and financial services in a structured and sustainable manner, he added.

The enabling ecosystem will also bridge the gap between government schemes and people living in geographically difficult terrain, he said.

Sinha asked the concerned officials to explore all possibilities for extending financial handholding to the eligible beneficiaries through various government schemes and interventions.

Jain highlighted the importance of increasing the presence of banks for greater financial inclusion.

He informed that the implementation of government sponsored schemes is monitored through the UT-level bankers’ committee at periodic intervals.